Project Management on Bank’s Financial Costing

Research question: Is the Cost makes a major impact on projects? If the answer is “Yes” Cost impacts, then whether over forecasting and budgeting for a project will be retained in the next few years or tight Costing control will be followed to fit project for specific time frame. The question lays as show-stopper for many projects which are running during the current pandemic situation?

Research Tasks

In the earlier centuries, there were no adequate way of handling project management in financial and other sectors without using any technique and any specific tools but with over period of time as it gradually brought improvement to the professional standards for meeting and satisfying business requirements of the clients.

In the Modern era of business and technologies, Project Management has become a key role in the area of Financial Banking Institutions and other sectors all over the world. Projects could be run strictly following PMI standards and tools or by general practices according to the experience set of project management professionals from Asia, Gulf, Europe and US markets.

In the current real world, Professionals with knowledge management on the products and its methodology tools were well established in the area of Project Management by learning skills to manage projects well on Scope understanding/Freezing, Financial Costing, Time/Scheduling and Quality Management as a base-lined environments. This article discusses in detailed about Bank’s Financial costing and their tools used in their banks to simplify their products and track cost in effective and accurate manner.

Theoretical Background

Project Management is starting to mature at individual and corporate levels, and business are understanding not just the benefit, but the fundamental need to adopt such practices if they are going to deliver projects ‘faster, better, cheaper’. Such aims are truly attainable, but only if less effective organizational practices are replaced by more concurrent and Integrated project organization during key phases of projects.

Projects were managed geographically across continents as teams were segregated at different countries/locations with the current situation of pandemic and process their work accurately. Further Project Management teams were able to manage and deliver projects residing in one location and managing different teams from different locations with the success ratio going beyond expectation.

Financial Costing will face a major difficulty in scope management, due to scope creep which leads to rise in additional change requests after scope freezing of a project. The Change request form enables you to get all the relevant information about the change and evaluates its potential impact on the project. The form should ask the requestor of the change for four pieces of information:

1. The requestor’s name,

2. The date of the request,

3. The desired change and

4. A justification for the request on the project

The change request should also have questions which needs to be answered:

- How many hours of work would be involved in completing the change?

- How would the change impact the existing work packages?

Once the information is obtained, Project manager must evaluate this information and answer two final question:

- What would be the estimated cost of both implementing and not implementing change?

- What would be the overall impact to project of doing and not doing change?

Once questions have been answered, someone must accept responsibility for the choice to implement the required change. Usually this should not be project manager, but the project sponsor or other stakeholder. The end of this process occurs when signed authorization to either do or not do the change received.

In some instances, a Change Control Board (CCB) or a Change Review Board (CRB) can be effective part of this activity. A CCB or CRB is a committee with the authority to authorize project change. In most cases this board should be chaired by the project manager as they have ultimate responsibility for delivery of the project.

Discussions

Complexity is the term of reference for intricate structures and connotes a high degree of complication, difficulty and entanglement. Something complicated is involved and difficult to understand; but the complicated problem still has at-least one solution. Something complex involves true uncertainty and unpredictability so a complex problem does not have a single solution and perhaps not even a best solution of this article.

The International Project Management Association (IPMA) uses the following criteria to define the complexity in projects:

A complex project fulfills all of following criteria:

- Many interrelated subs-systems /sub-projects and elements should be considered within the structures of a complex project and in relation to its context in organization.

- Several organizations are involved in the project and/or different units in the same organization may benefit from or provide resources for a complex project deliverable.

- Several different disciplines work on a complex and key project

- The management of a complex project involves several different, sometimes overlapping phases also

- Many of the available project management methods, techniques and tools needed are applied in the management of a complex project.

IPMA offers a self-assessment tool that identifies three types of complexity.

1. Environmental complexity

2. Content complexity

3. Resource complexity

Degree of complexity can be judged on a scale of 1 to 4, where 4 is very complex. Environmental complexity has four components:

1) strategic importance of project, 2) political conditions (if there is much disagreement or a demanding decision making process), 3) number of unpredictable stakeholders who need individual care, and 4) dimension of change imposed on environment.

Similarly, Content complexity has four aspects:

1) complicatedness or unpredictability of project result, 2) technological innovation, 3) result structure, and 4) timeline and number of parallel activities.

Likewise, Resource complexity involves 1) budget, 2) skill mix, 3) organizational structure, and 4) geographic distribution.

{The Project Office as Project Management Support in Complex Environments by Gunnar Widforss and Malin Rosqvist}

The model for quantitative risk analysis involves three steps:

Uncertainty analysis - This consists in quantifying and defining a range of uncertainty in the completion of individual tasks in schedule in terms of cost and time. Such uncertainty is due to individual, special and specific risks of each task, which must be defined by the specialists in charge of task. From total set of tasks in the project schedule, subsets that accordingly to expert judgment are likely to affect the project due to cost and/or time overruns are selected. Once these subsets of tasks have been defined, the minimum, most probable and maximum uncertainty values are quantified and values feed into probability distributions of the model.

General risks - This step consists in the identifying and quantifying risks that affect the project as a whole, dividing them into the following: technical, administrative, social and environmental risks. Quantification is done by defining a probability of occurrence and an expected impact in terms of cost and time.

Correlation of tasks - This consists in correlating, within the model, interdependent tasks within the schedule. A correlation matrix is defined with the tasks and correlation coefficients.

{ Methods for quantitative risks analysis of cost and deadline overruns in complex projects by Paúl Urgilésa* , Juan Clavera and Miguel A. Sebastiána}

COCOMO (Constructive by the follies of Cost estimation model is Mode1) introduced by the U.S. in 1981 at the University of Southern California (Southern California) leads of software engineering research center Oehm professor Barry W.B proposed a new Cost estimation model, the model is simple, clear and simple concept, and soon got used wide attention and application. In COCOMO model, considering the development environment, the software development projects in the overall types can be divided into three kinds: tissue (Organic), Embedded type (Embedded) and between the above two software Semidetached between half independent model. COCOMO model according to the detailed degree into level 3: namely basic COCOMO model COCOMO model - middle, and the detailed COCOMO model. Basic COCOMO model is a static univariate model, it USES one has an estimate of source Code number (LOC: of Code) as the independent variable has the (experience) function to calculation software development effort. COCOMO model is in the middle of the LOC as independent variables with the calculation software development workload (now known as the basis of nominal workload), reoccupy involving products, hardware, staff, projects attributes to adjust workload of factors affecting estimated. Detailed model including COCOMO COCOMO model among all the characteristics, but the use of such various factors affecting the adjustment, consider workload estimate of software engineering process every step (analysis, design, etc.) influence.

{Summarization of Software Cost Estimation by Xiaotie Qin and Miao Fang}

Methods and Findings

In this article, we are going to discuss about the real-world experience on Project’s Financial Costing taking place in banks across Europe, USA, and Gulf region. The detailed discussion is on following business cases:

European Banks – Business Case – 1: Summary

India Off-shore IT company is managing parent European Bank IT management for their Core Banking system which is going to be discussed in detail with required information:

American Banks – Business Case – 2: Summary

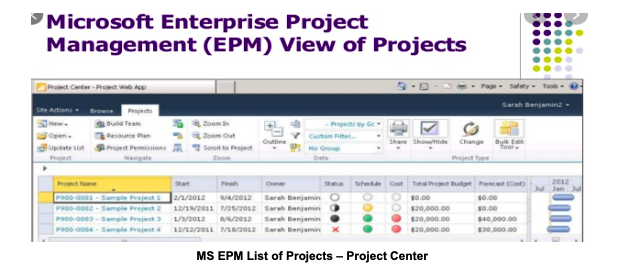

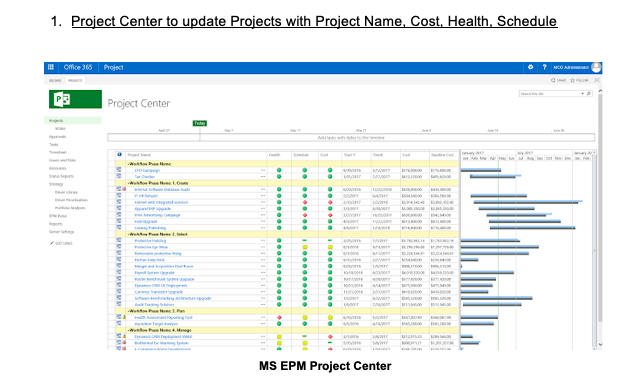

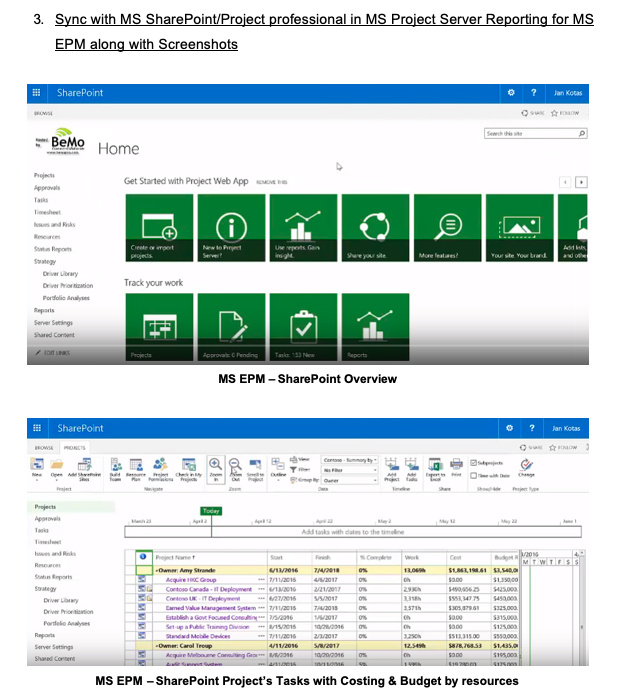

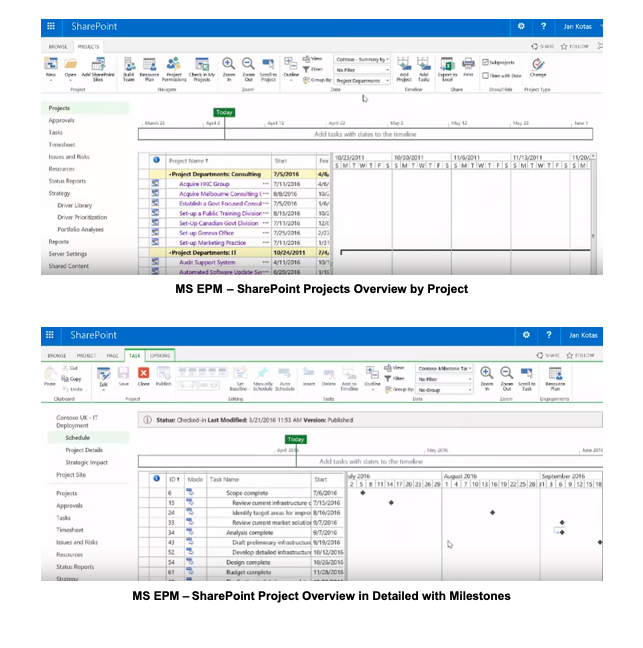

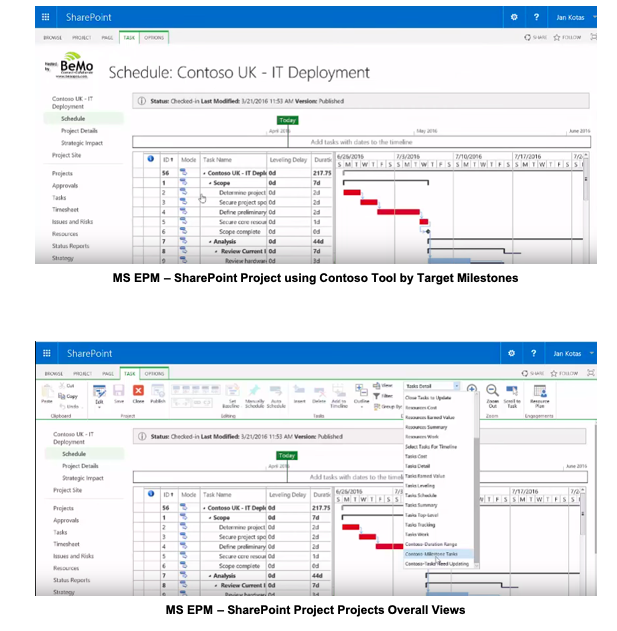

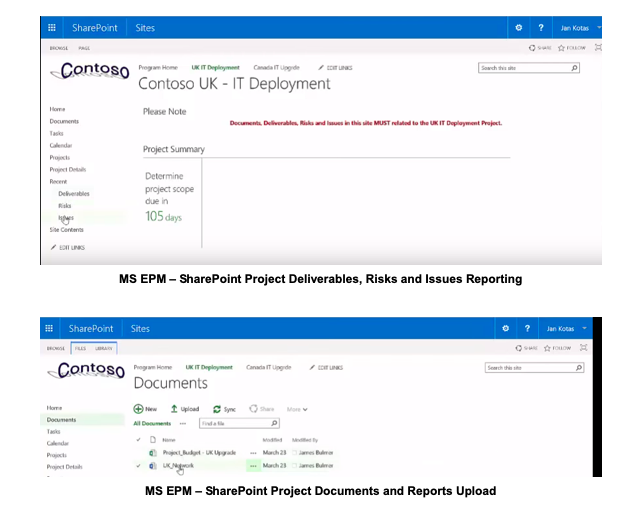

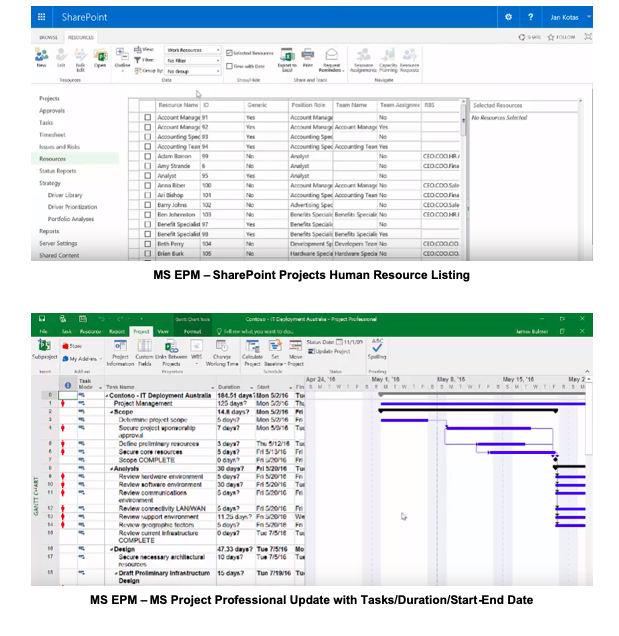

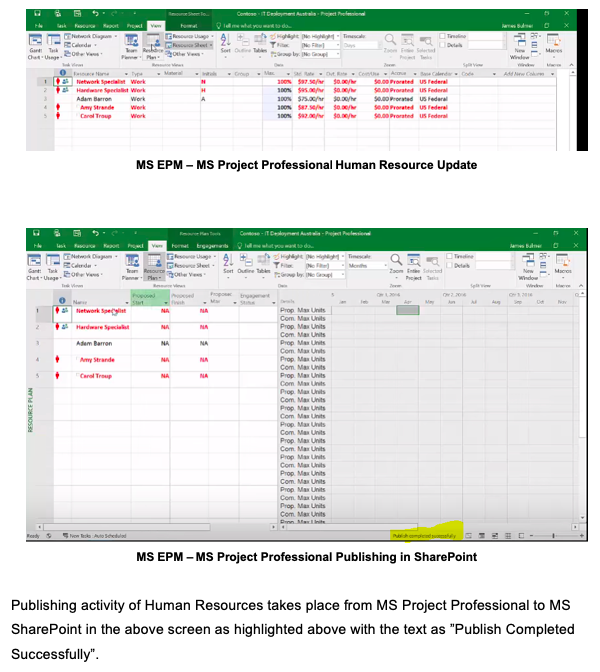

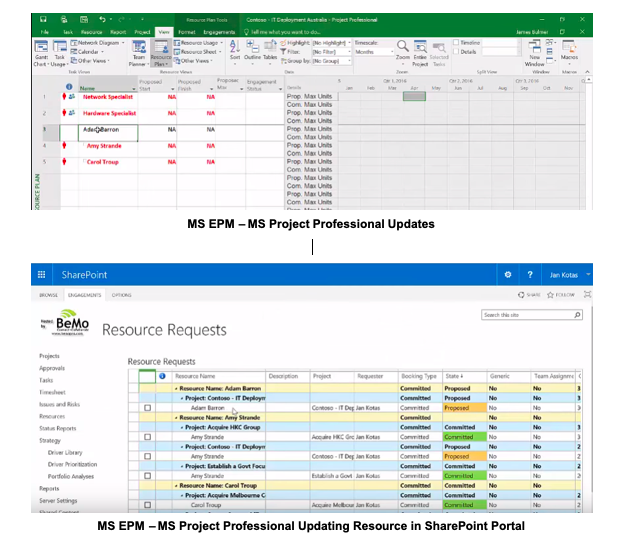

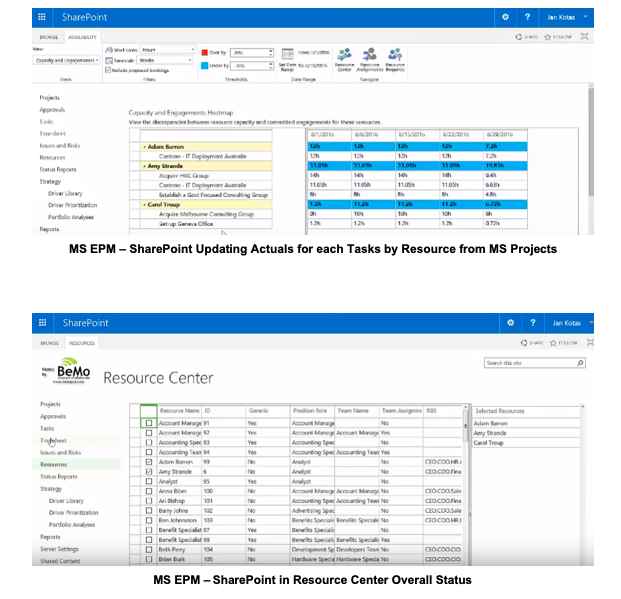

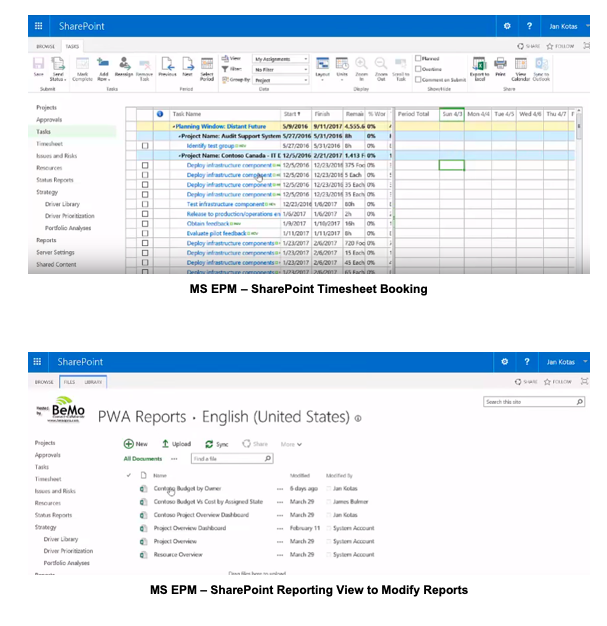

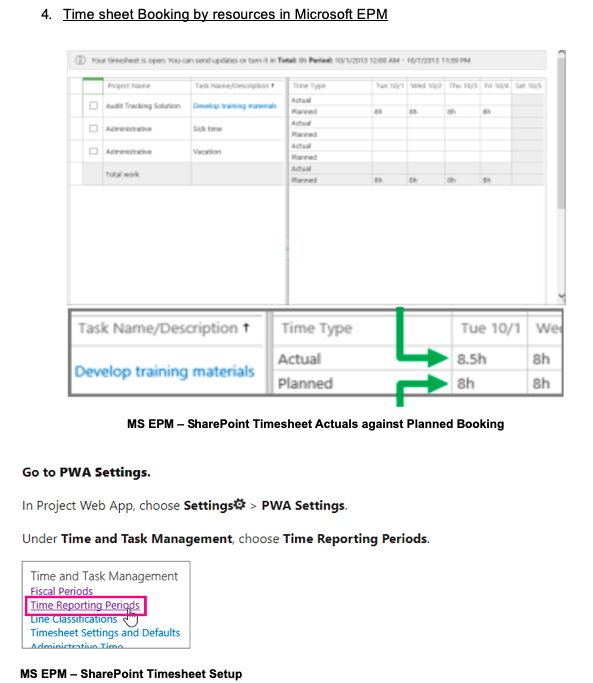

American Bank’s project management handled by Dubai IT Out-source company for describing Detailed/Milestone Plan for a project and discuss in detail on Microsoft Enterprise Project Management system (EPM) with cost handling on human resource management:

- Project Center to update Projects with Project Name, Cost, Health, Schedule

- MS Enterprises Project Management Solution

- Sync with MS SharePoint/Project professional in MS Project Server Reporting for EPM

- Time sheet Booking by resources in Microsoft EPM

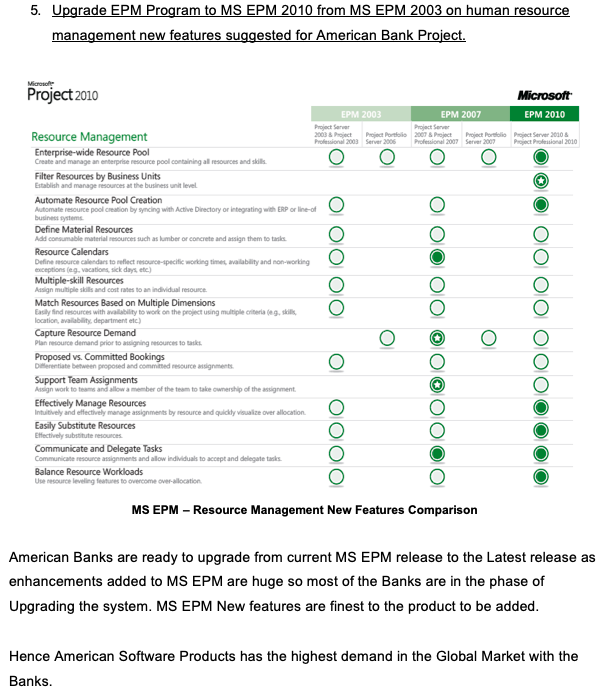

- Upgrade EPM Program to MS EPM 2010 from MS EPM 2003 on human resource management new features suggested for American Bank Project.

Gulf Banks – Business Case – 3: Summary

Gulf Bank’s project management handled by Capital Market Business company to discuss on Project Monthly Status Report & Business Strategy Cost Demand on Projects and how to change project tools from manual process for future automation as no tools used.

European Banks - Business Case - 1: Elucidate and Illustrate

Project Management – Banks’s Financial Costing Process

European banks are great leaders in Banking Industry and able to demonstrate Global leadership in Banking Market. The British multinational banking and financial services company is headquartered in London, England. It is a Universal Bank with operations in consumer, corporate and institutional banking, Investment Banking and Wealth Management, Private Banking, and treasury services. Interface Systems used by the Banks are Independent to country’s regulatory requirements.

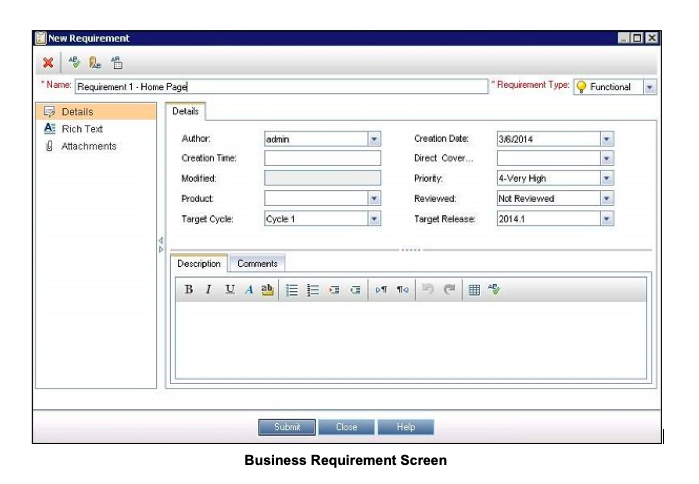

Initially Country Business need to log a request in RMS thru their Online Portal, then it will reach to HP ALM via. Off-shore IT Company. Business Solution Head (Functional/Technical/ Interface) must assign a Business Analyst who will evaluate feasibility study for the requirement which can be met in the current release or Future release or retro fit can be made from some other country releases. Business Analyst will decide after discussion with Business Solution Head and Design Team, if this requirement is possible or not in the product checking by code or by sample data in the product.

A New Entry must be updated in the below excel file “Master List for Projects” under the column ‘Fund Approval Status’ as ‘Pipeline’ and other fields to be updated which are available from RMS system.

Master List for Projects Estimation Email sent to Country Head and their acknowledgement for Approval

Approval email must come from Country Head’s or Country’s CEO mentioning Cost Centre and approved cost (estimated cost would subject to negotiations to reduce and bring down the cost) from stakeholders of projects then it will be marked as “Approved” as mentioned in excel file “Master List for Projects”. Sample Country Email acknowledgement is mentioned above, and Cost Estimation process will be discussed in the later part of this article.

IT Team is being contacted by different Countries for requirements in their country release via. their Project Manager assign to their country. It will be decided, if the project enhancement will meet in the current release/tranche or out of release or next release/ tranche based on the cut-off dates for approval from Country Head will be taken up. Basically, tranche to a tranche the duration is 3 to 4 months. Based upon their criticality and regulatory preventions, it must be any of the Lists from the excel “Master List for Projects” on column ‘Business Benefits’ or different Business benefit for their consideration as listed below:

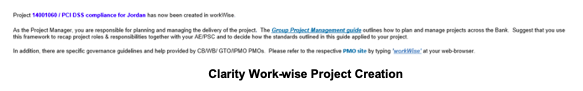

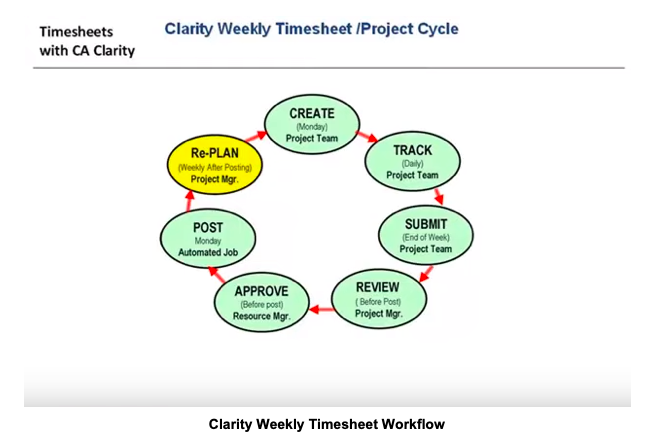

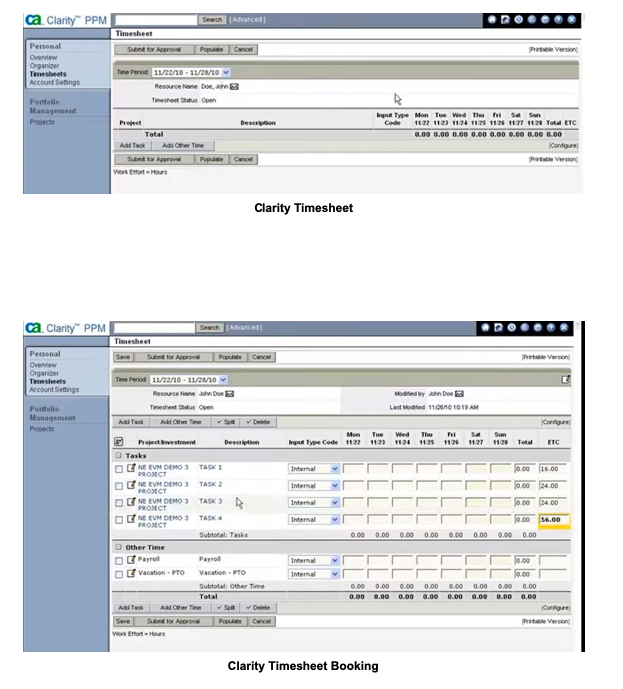

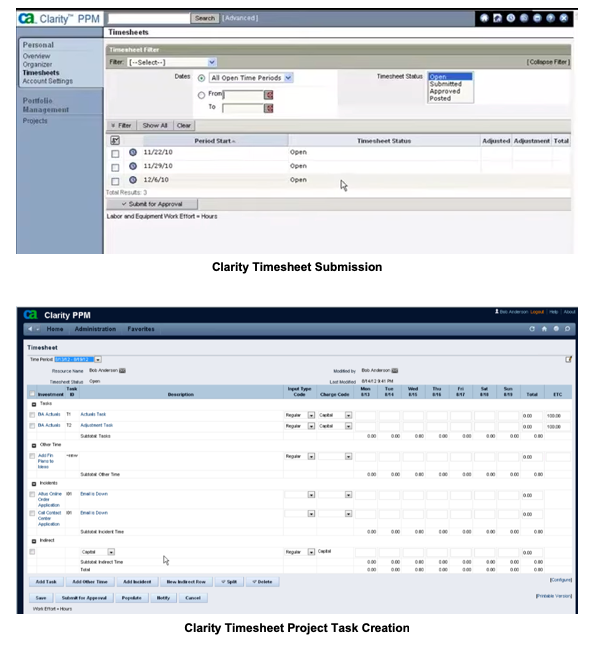

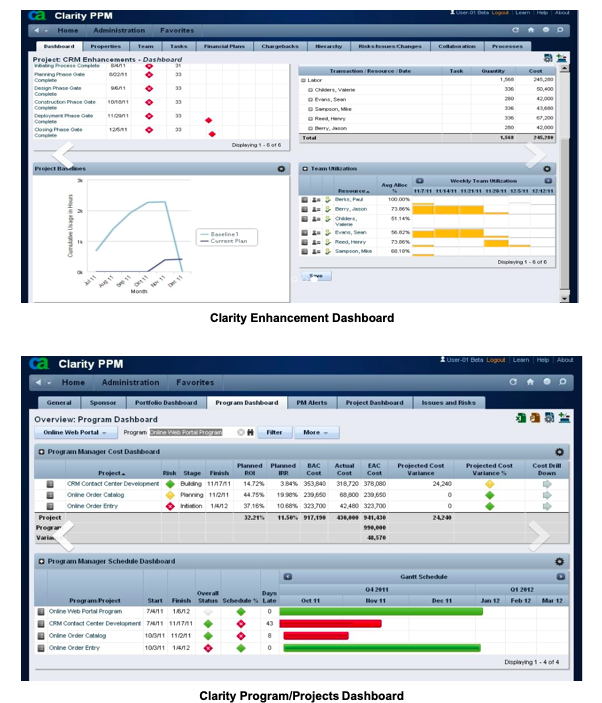

Next step is Project Id creation which is time task activity handled by project work-wise team. To manage this task, project manager needs to follow-up every week based on the priority of the project, as different teams will ask for Project Id to book in Clarity Timesheet. Sample Clarity Project Id creation to Project Manager is stated below for reference:

Clarity Work-wise Project Creation

Project Id is also updated in the Master Project list under the column ‘WW Project ID’ to keep track of every update in the excel “Master List for Projects” since it is project master.

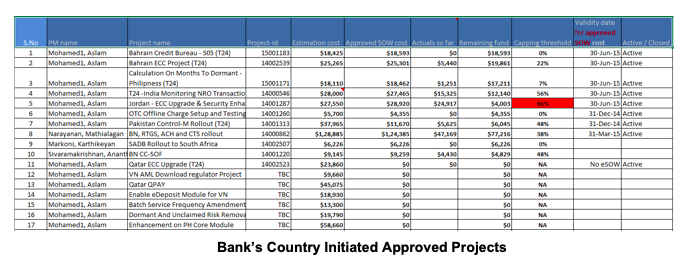

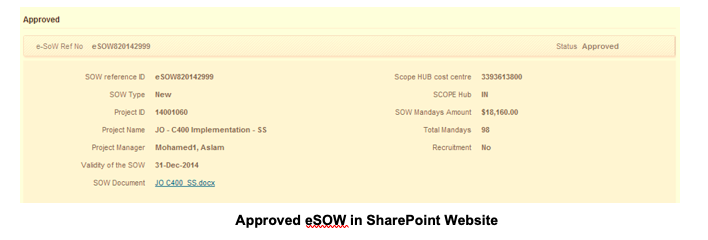

Separate Excel is maintained for defining “Approval” and “Pipeline” Projects. Approved Projects are defined and to identify then maintain fields for Total Estimated Cost, Approved SOW (Statement of Work) Cost, Actuals which are booked funds in Timesheet, Remaining fund and Validity for approved SOW Cost and Project Status and these fields are crucial to identify Bank’s Project Financial cost for Project manager.

Listed below screenshots of “Approved” projects to manage finances.

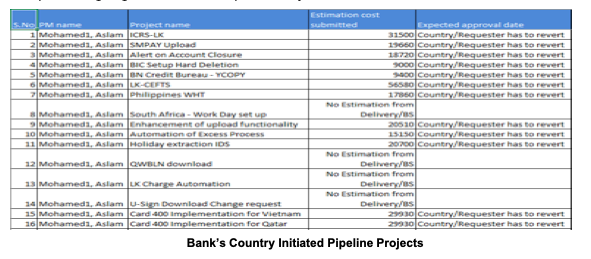

Pipeline Projects are Listed in the Excel with the fields Estimation Cost Submitted, Excepted Approval date from the Country Head to revert. This means if we receive approval from Country then it moves the entry from Pipeline to Approved List.

Sample Listing is given below for Pipeline Projects:

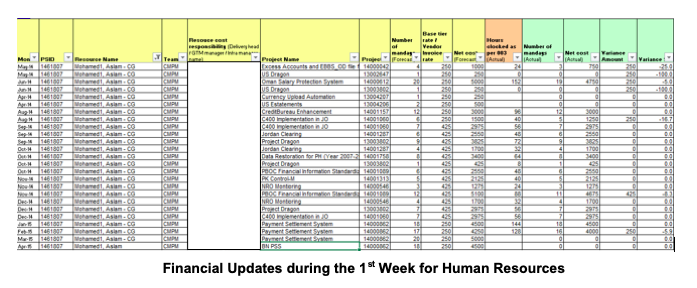

Every Month period of first 5 days, every project manager must receive Actuals to be booked for the month in Timesheet from different teams. There must be an update coming from different teams to book timesheet for resources. Clarity Project and Portfolio Management tool needs to be defined before the end of 10th day informing timesheet against resources which need to be booked for the month, if there is any variance, then, it needs to be reported to Delivery head for escalation as different teams have not met basic project requirement of costing finances.

Project overview Summary in Clarity system will appear in Red if proper match is not found for projects other status are Amber/Green if little or no variances.

Listed below details provide information about Projects which resource must book on that specific month:

Financial Updates during the 1st Week for Human Resources

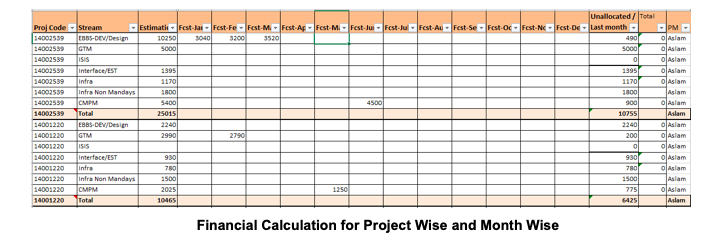

Manual Financial Management of Projects month-wise for a year maintained in excel by different teams which are booked as actuals and it tells exact funds utilized for a particular month which is stated below:

Sample Screenshots below show Electronic Statement of Work which is created by Project manager through SharePoint Site having unique SOW Reference number then related fields to Cost Centre, Project ID, Project Name, Man days amount, Total Man-days, Project Manager Handled this project, Validity of SOW and SOW Document followed by Financial Approval and IT Heads approvals.

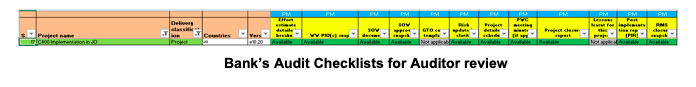

Audit Checklists

In every Bank, there is an Internal Audit Team validating whole process of the bank against their process documents and their systems which can be provided for evidence and compliance reason. The Internal Auditors responsibility is to find and report the issues on operational and technology process on systems to Chief Risk Officer in their department or bank-wide officer then respective corrective measure are taken to rectify this issue internally by different departments.

There are few external auditors i.e. E&Y, KPMG, Deloitte, PwC are appointed by Stakeholders or Steering Committee or Board of Directors of Banks to Audit their respective departments and collect the issues & their findings then recommendation are made to rectify the issue and findings which lead to solution of this problems reported by external auditors.

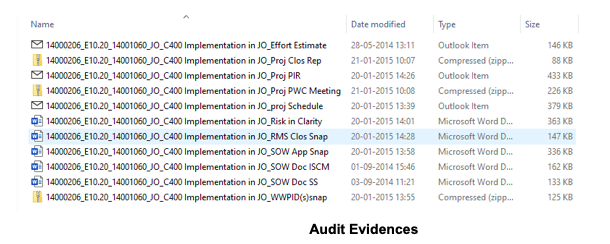

Sample checklist provided for Internal Audit Team to audit this information and their evidences are also provided, which is listed in the forms of documents in next figure:

Audit Evidences

This way all the projects finances are managed to get accurate results in the projects and the real objectives is not to appear in “Red” Status (RAG - Red/Amber/Green) in Project Overview Summary as discussed later part of this paper refer Page 42. If any chance happens then it must be escalated to IT Head of Off-shore Company.

Lesson Learnt:

Each and every project must always provide Lesson Learnt to be made for a project manager. This way, we need to capture and identify these points then highlight to the Top management for re-occurrence in another project.

The European bank project managers manage costing and finances well and are professional in terms of compliance and their processes within the regulatory measures.

Cost Estimation Process in Banks

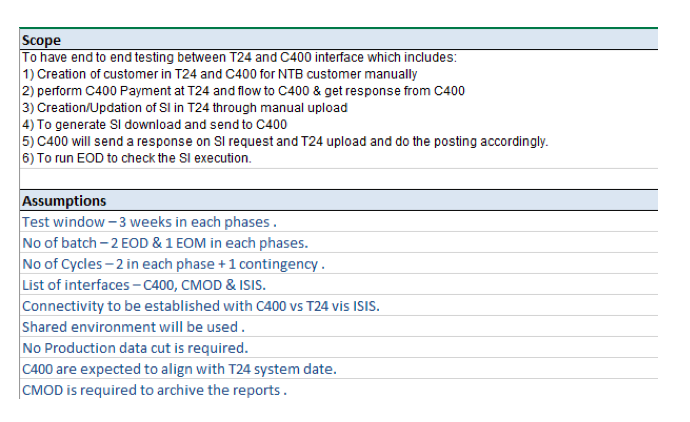

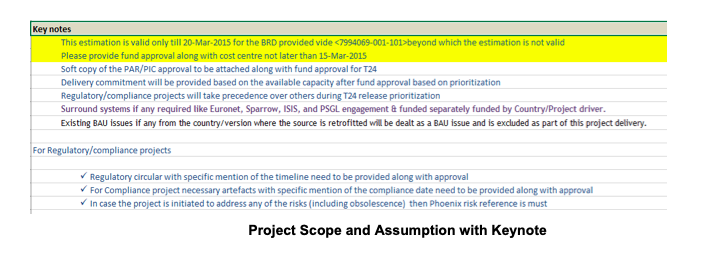

1. Project Scope and Assumption

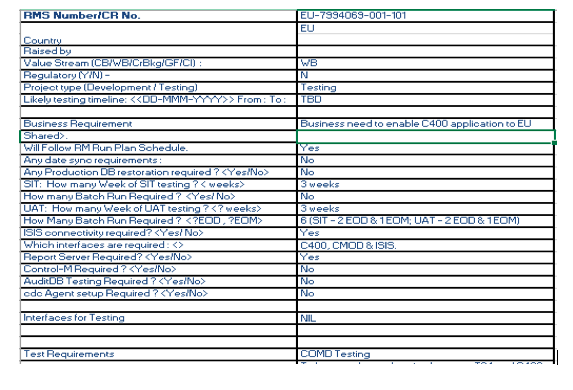

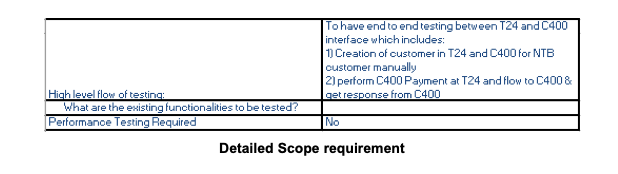

Every project meets certain Assumption and Scope definition so that product enhancement achieves the objective and goals for fulfilling their requirement. Scope will be defined by product specialist in turn Business Analyst, Business Solution Manager and Delivery Head will do joint discussion to provide product solution. Assumption are obtained as general knowledge on the product to be achieve like how much Testing Window period, Batch processing – No. of End of days, No. of End of Months and their cycles, Interface involved, Interface connectivity, Dedicated or Shared environments, Any Production data requirements, Interface and Core Banking system sync dates, any other requirements etc.,

2. Cost for Scoping requirement

These details are extracted from RMS system to find details if it is development or Testing Support project, Work/Value Stream, regulatory or other requirements, Testing requirement statistics and other details to arrive on test plan and testing cycles etc.

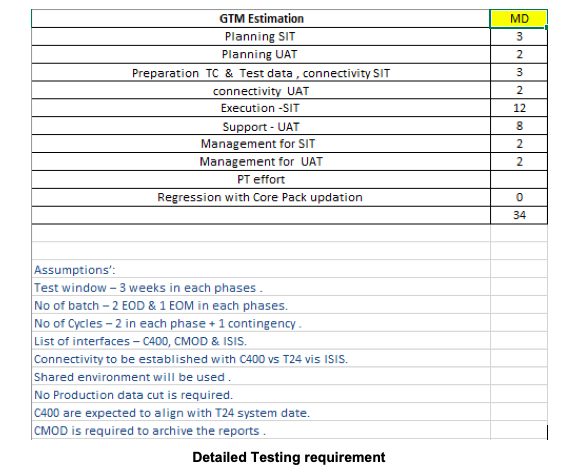

3. Cost for Testing requirements

This requirement is for GTM Team to describe detail testing effort to test this enhancement. It identifies plan for Connectivity testing, SIT, UAT, Unit Test cases preparation, Generate Test data, Performance Testing if any, Regression etc.

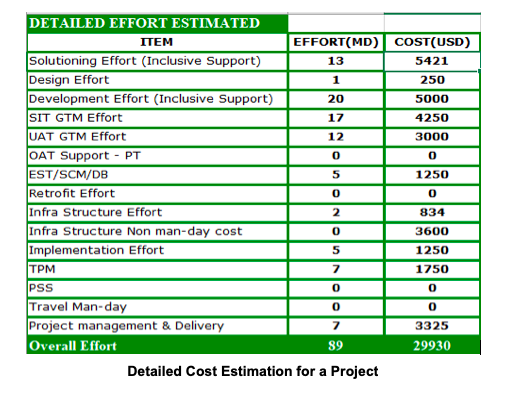

4. Cost Estimation Report

Estimation report is prepared to identify set of teams involved in this project and their actual efforts or man-days to complete this requirement for country’s enhancement. The Estimation report states about Project details in brief, Existing components which requires change and impact on this change, Total Efforts from different teams etc., Sample Cost Estimation report is stated below

5. Final Cost Estimation Pattern

The final cost estimation is obtained by collecting information from Point 1, 2, 3 and 4. This is how Detailed Effort estimation is captured for all the projects in a bank.

This estimation is drafted as an email to the country Head or who raised requirements in RMS system.

System Tools Used in Banks

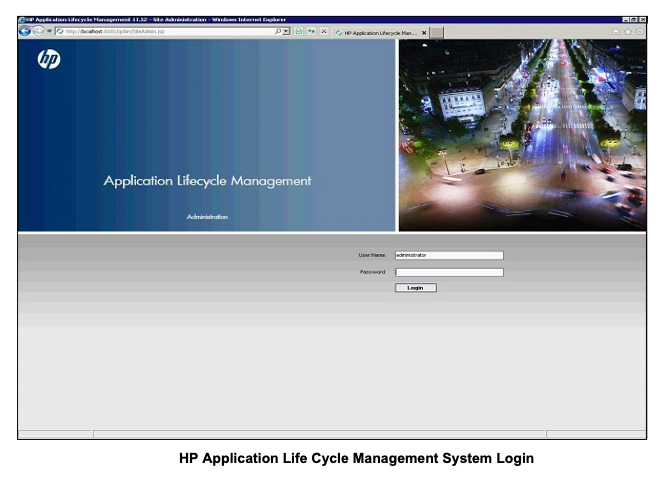

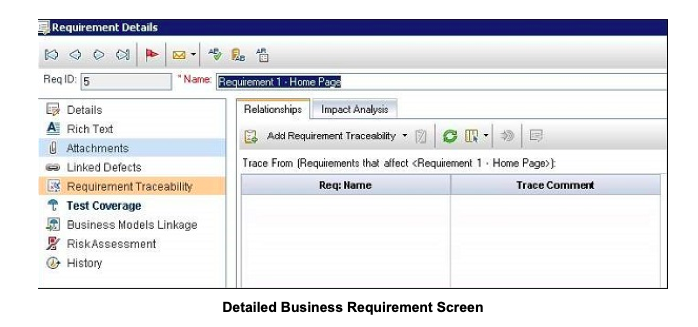

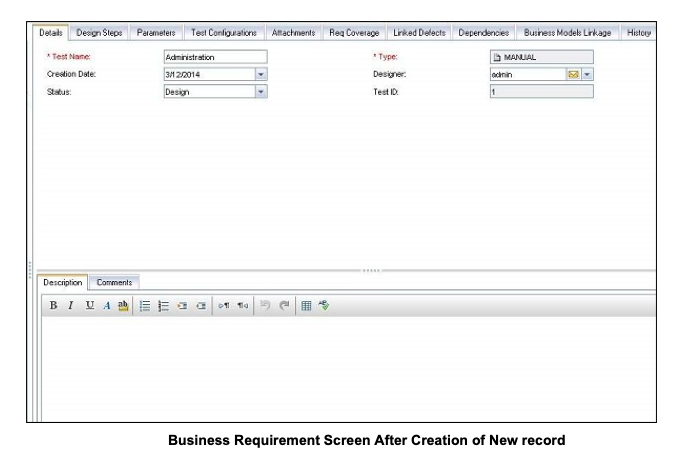

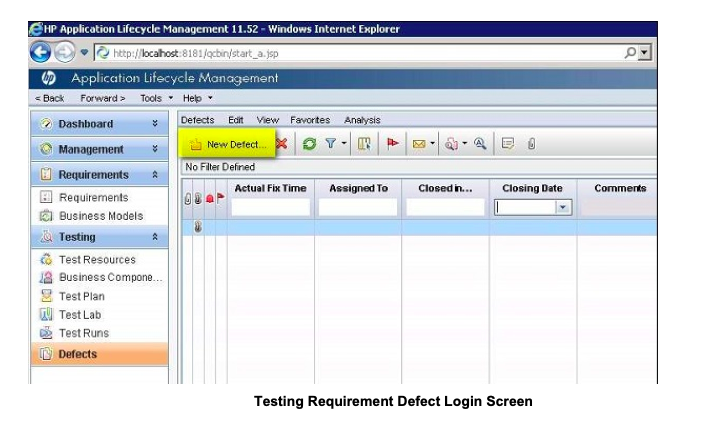

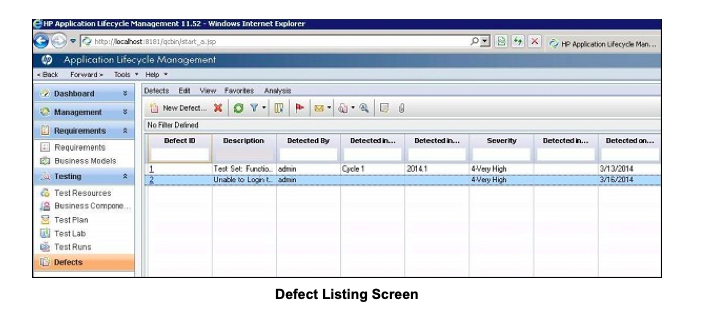

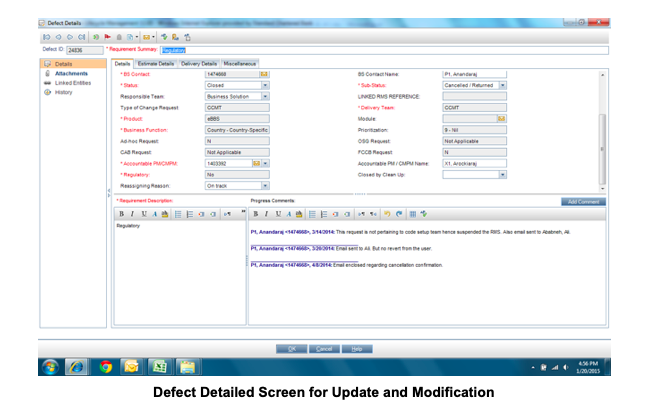

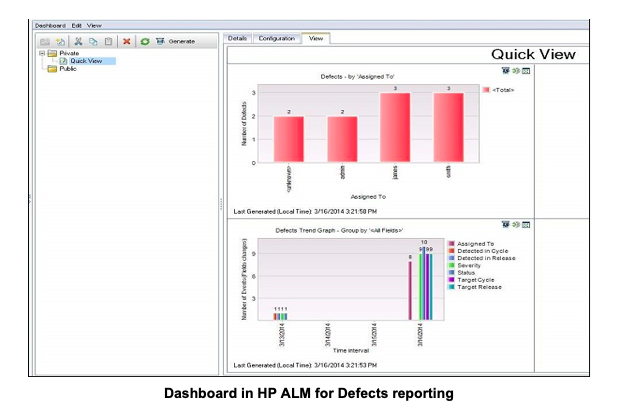

Tool – 1: HP - Application Lifecycle Management or Quality Center

HP Quality Center (QC), a commercial test management tool by HP, supports various phases of software development life cycle. It is popularly known as HP-ALM Application Life Cycle Management. HP Quality Center is also available as a Software-as-a-Service offering. This gives you an in-depth understanding on HP Quality Center, its way of usage, project tracking and planning, and other tabs in QC such as Management, Test Plan, Test Lab, defects management and Dashboard view.

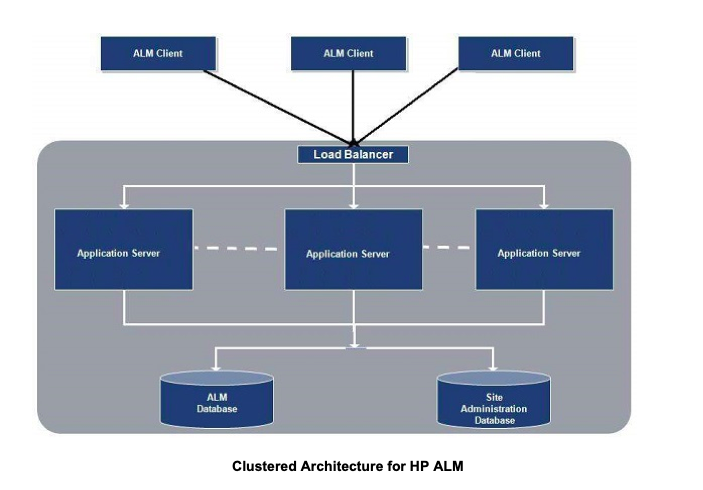

HP-ALM is an enterprise-wide application that is based on Java 2 Enterprise Edition

(J2EE) technology and uses MS SQL Server or Oracle as its back end. There is also a load balancer to effectively cater users’ requests.

Site Administration Database is hosted on a standalone database server, while other project related data are stored on a separate database server.

The following diagram shows how the setup of QC would be in a large corporation.

HP-ALM helps us to manage project milestones, deliverables, and resources. It also aids in keeping track of project health, standards that allow Product owners to gauge the current status of the product.

Tool – 2: CA Clarity – Project and Portfolio (PPM) and Timesheet Management

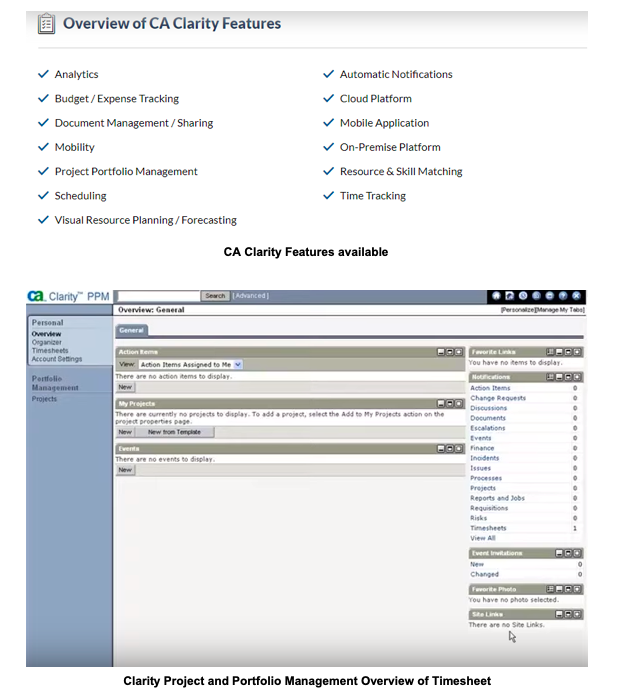

CA Clarity is a Project and Portfolio management (PPM) platform that helps businesses effectively and efficiently manage their products, services, peoples, and finances. The platform is aimed to facilitate and improve the delivery of projects and programs.

With CA Clarity, banks can devise and execute sound strategic investments and business decisions. The solution helps users follow and prioritize the right market and customer requirements, allowing them to invest their resources as well as maximize their enterprise, IT, service and product portfolios. The system can be deployed as an on-premise solution or as a cloud-based service with both a hosted and SaaS delivery option. It can be accessed via a web browser as well as mobile devices with an internet connection.

CA Clarity – PPM Summary, Risks, Issues to be reported in the system

CA Clarity PPM enables Banks and organizations to put their portfolio of resources, projects, and budgets into a more centralized setup and effectively manage each aspect using scorecards to objectively analyze and compare requirements across the complete portfolio. The solution encourages financial transparency as users are granted time control of billing, invoicing and charge back allocations making management more effective in handling budgets for more enhanced cash flows.

CA Clarity also provides support for project control, with users getting the right tools to effectively manage schedules, status, and costs. Management personnel can also view each project and make sure that qualified individuals are assigned to their tasks to deliver the best project service in a timely manner. Banks have access to the information allowing them to come to smart decisions on development, investment, consolidation, or retirement of these applications.

CA Clarity helps users in establishing portfolio standards and metrics to help them assess their portfolio investments against business indicators, including ROI, break even analysis, revenue enhancement, quality improvements and other relevant statistics. Clarity PPM also comes with an integrated KPI tracker built with several pre-defined KPIs as well as an advanced Analytics module for deeper analysis and performance monitoring.

Overall, Clarity PPM brings to the table capabilities and functionalities that allow companies and Banks to make better decisions regarding their portfolio and help them align their business strategies and market requirements to help attain their goals, while remaining cost effective without compromising the quality of the delivery of project service.

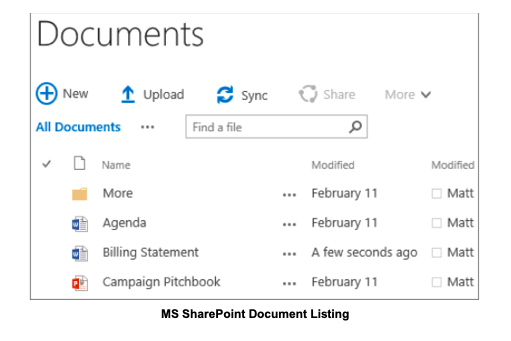

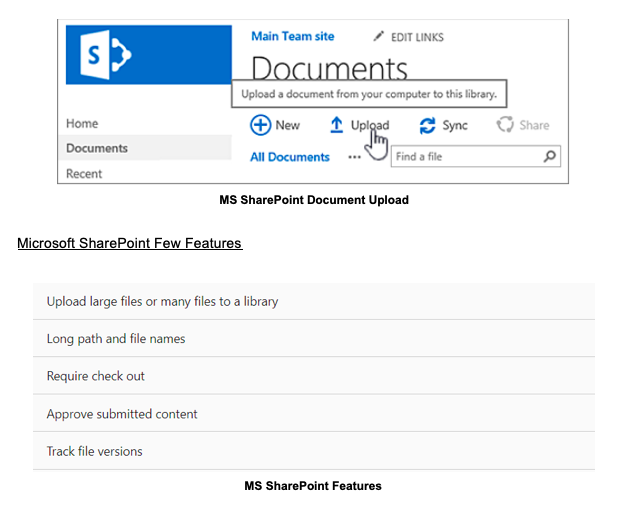

Tool - 3: Microsoft SharePoint for Document Management

Banks are using MS SharePoint to create websites. You can use it as a secure place to store, organize, share, and access information from any devices.

All you need is a web browser, such as Microsoft Edge, Internet Explorer, Chrome, or Firefox.

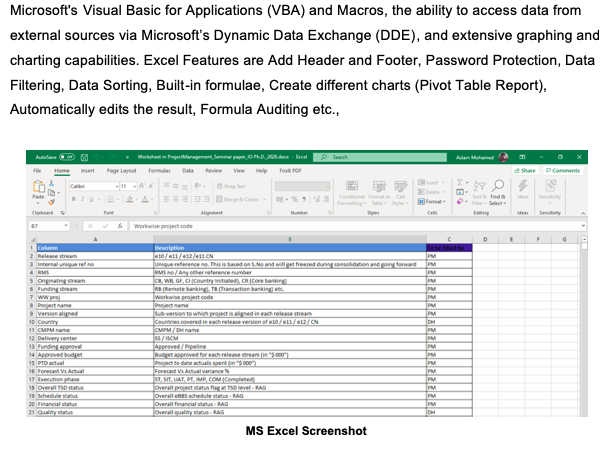

Tool - 4: Microsoft Excel from MS-Office Suite

Microsoft Excel is a spreadsheet program included in the Microsoft Office suite of applications. Spreadsheets present tables of values arranged in rows and columns that can be manipulated mathematically using both basic and complex arithmetic operations and functions.

In addition to its standard spreadsheet features, Excel also offers programming support via Microsoft's Visual Basic for Applications (VBA) and Macros, the ability to access data from external sources via Microsoft’s Dynamic Data Exchange (DDE), and extensive graphing and charting capabilities. Excel Features are Add Header and Footer, Password Protection, Data Filtering, Data Sorting, Built-in formulae, Create different charts (Pivot Table Report), Automatically edits the result, Formula Auditing etc.,

American Banks – Business Case – 2: Elucidate and Illustrate

This bank deals with Corresponding Banking and situated in New York as part of Dubai subsidiary branch operations. They were able to handle fund transfers payment between Asian countries and USA through FED and Bank of New York. They were able to do more business with trade finance products from region to another. Interface systems use by the bank are FED, SWIFT, E-GIFTS, AML, and OFAC processing to compliance with Federal Reserve regulators.

Project Illustration

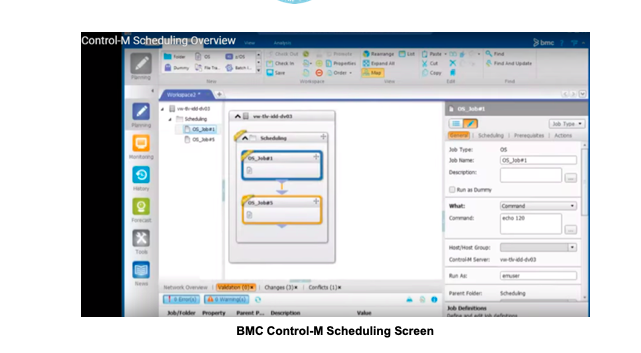

To stimulate this business case, take an example of a Project “Control-M” which happens in American Bank. To understand brief about this project so let us know more on “Control-M”.

“Control-M helps you to speed up and simplify application delivery, improve SLAs, and manage the behind-the-scenes data and applications that batch jobs scheduler require. It integrates, automates, and orchestrates application workflows across on-premises, private, and public cloud environments, so your jobs get delivered on time, every time.

Automating workloads is easy with Control-M to View, automate, and manage your batch workflows and file transfers from a single view. Automate big data workflows with native integrations and Automate conversions from existing schedulers and scripts”

In this business case, Control-M Project is used to automate Close of Business Jobs to be scheduled in T24 System without Human Interaction in Data Center during running COB and only during crash or error time then T24 System Admin will come into action for support.

This project was implemented by considering technical difficulties in COB Operations during the current process. This project was initiated by following Detailed Project Plan from the excel attached but due to time-constraint, project was handover to another project manager. The current project manager moved out of this project to handle different projects. After facing obstacles in the project, when it is nearing success with no indication of failure, the current project manager is changed. This is typical example for scope getting change with respect to project manager and new project manager takes at least 2 to 3 weeks to understand and stabilize the project which may impact Financial Cost as well as time/schedule will increase.

Sample Detailed Project Plan, Assumption made, and Milestone Plan are stated in the attached excel:

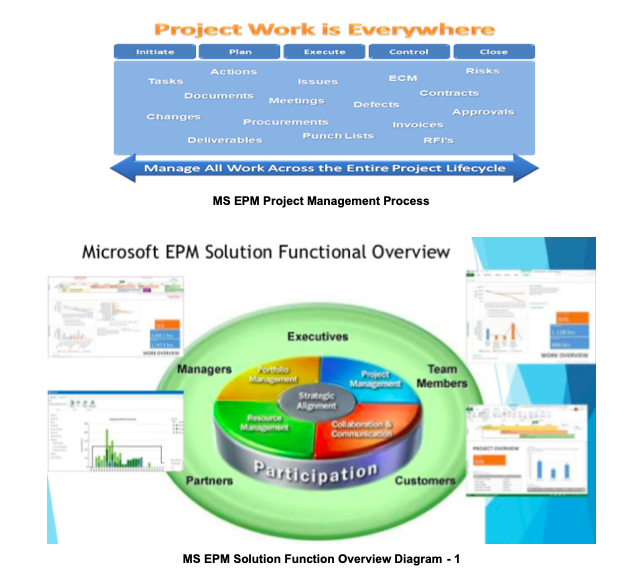

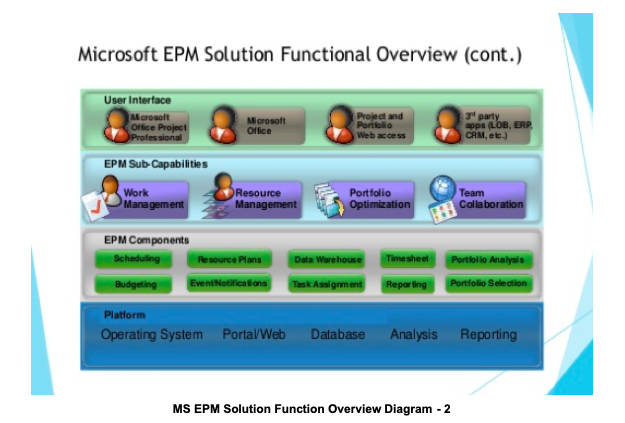

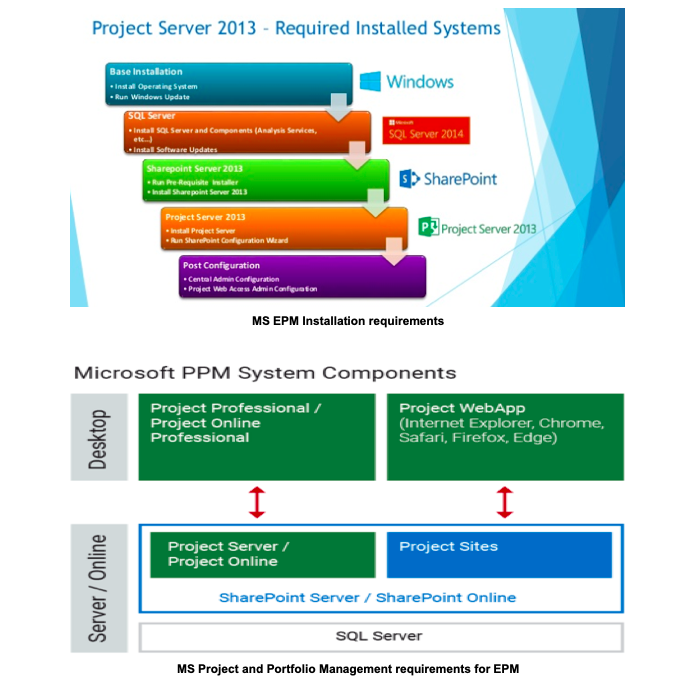

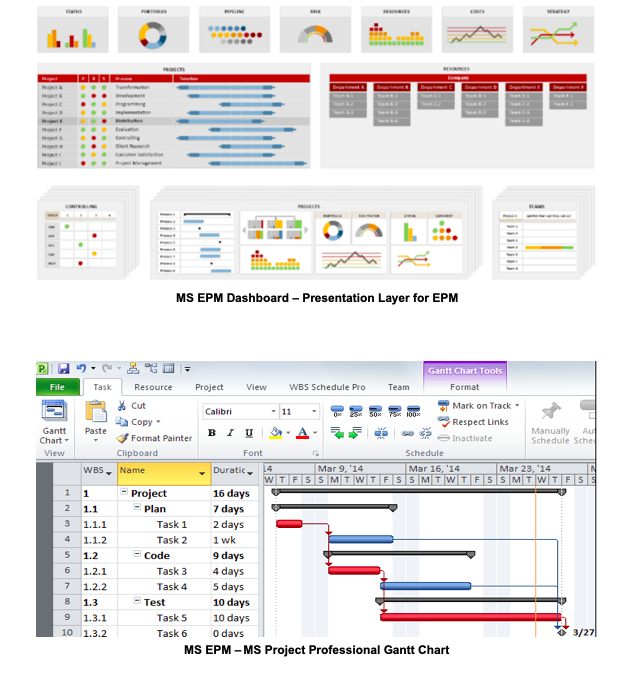

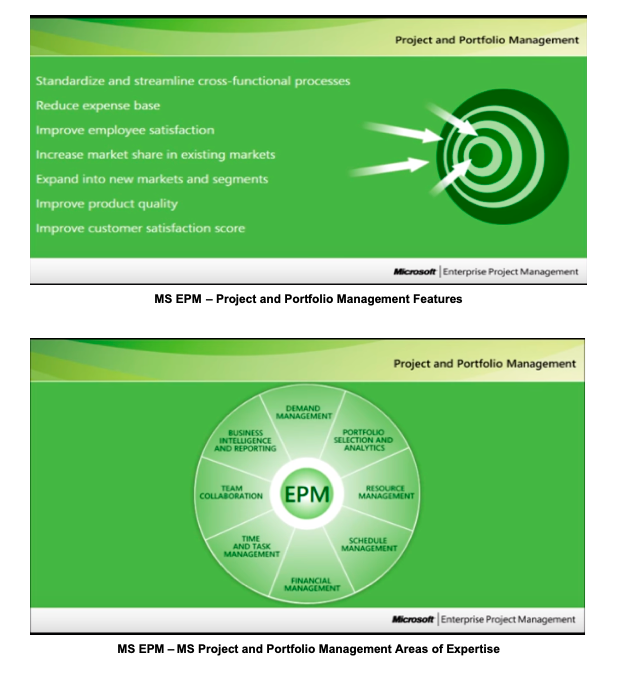

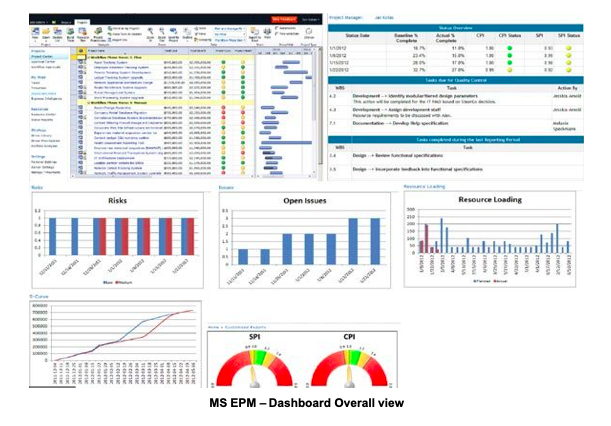

Microsoft Enterprise Project Management (EPM) System Used by American Banks

The Microsoft EPM solution is a flexible, end-to-end platform, used across a broad variety of Banks and industries to select and effectively deliver the right project portfolios.

Microsoft EPM Solution provides innovative capabilities for managing the entire portfolio of projects/ programs initiatives. This comprehensive solution offers a robust platform to banks / organizations / departments for collaboration, communication & deliberation.

The complete Project Lifecycle, right from Idea / Proposal inception till closure could be planned, executed & monitored. All kind of project phases & stages with respective processes and governances could be mapped in EPM solution. Organizations can take rational and calculative decisions on Project Investments, Resource Capitalization, Cost Augmentation etc. With EPM solution in place, the geographically dispersed team could manage the project activities, updates and converge the information into a central repository.

MS EPM Features, Viability and Area of Expertise

- Portfolio Management

- Resource Management

- Workflow and Process Management

- Costing and Budget Management

- Schedule Management

- Change Management

- Team Management

- Work Management

MS Enterprises Project Management Solution

The MS EPM Solution is a powerful solution provides a scalable and versatile platform so that every level of the Banks is very much effective. MS EPM is a perfect fit for any organization in need of Microsoft based Project Management Solution that will satisfy the unique needs of every workgroup. Work environment by today are more dynamic than ever. With tightening budgets, organizations and to do more with less work force. Productivity and efficiency give you the ability to manage all your projects. Built on a Microsoft SharePoint platform, EPM gives the ability to manage all work with one solution by leveraging what you already own in a familiar Microsoft environment.

Gulf Banks – Business Case – 3: Elucidate & Illustrate

These banks deal with Capital Market Business in Riyadh, Saudi Arabia which is regulated by Capital Market Authority (CMA). The Company manages Investment Business for Bank Customers, provide services to High Net Worth Individuals, Corporate Nationals and Residents for investing in different investment portfolios. The Basic need of Investment Business is to provide liquidity and profitable returns to their customers. The Investment Company uses specialized systems and products for managing their business i.e. T24 for Mutual Funds, Mubasher for Brokerage Securities/Bonds which is managed by Tadawul Stock Exchange, Asset Management Services, Investment Banking Services, IMSPLUS for Custody Services/Acquisition/Mergers, GT-Exchange for SWIFT and IPO Services to their Clients. The activities with core system are managed manually and handled through MS Excel tool.

Change Request Illustration

The Saudi Government implemented VAT – Value added Tax for the organizations and Banks with reference to VAT Percentage as 5% from January 1st, 2018. The tax payment is paid by the bank/company by 5th of every month. The General Authority of Zakat and Tax (GAZT) is responsible for managing the implementation, administration, and enforcement of VAT in Saudi Arabia.

To Meet requirement of VAT in T24 Core-Banking Software in product Mutual Funds was raised to Bank IT Team to be considered as Change request for completing the enhancement and Implementation during December 2017 due to strict deadlines by SAMA – Saudi Arabia Monetary Authority. The concept behind Mutual funds are Subscription (Buying MF’s) and Redemption (Selling MF’s) based on total amount or Units in the products. When a Subscription takes place VAT 5% is deducted as mentioned in the Change request document and Vise verse in Redemption. This change request was developed to meet and generate cost to government in Bank Books as financial costing for passing accounting entries in the system for VAT purpose.

Sample Change Request is attached below for your reference to investigate into functionality of this enhancement:

Project Monthly Status Report & Business Strategy Demand on Projects

The difficulty phases of handling Project Management with the capital business is that no tools were used by project managers for this environment. Whereas the bank’s IT Team was using MS SharePoint for SDLC Change management activities. As this process is Internal to the bank, SharePoint would not be to accessible in idle situation. All the activities and maintenance are done with the standard Microsoft Excel Tool which were very difficult to manage projects from project managers point of view. Basically, Financial Costing is managed by Bank side as budget is allocated for a year to the bank and its subsidiary companies based on which Capital Business get allocation for finance into IT Projects. Gulf Banks are not well established to work and implement tools like HP ALM, Clarity or MS EPM which they need to be capitalize soon due in future.

Sample Monthly Report and Project Strategy Demand is attached below for your reference to understand how portfolio is reporting to stakeholders is happening in Capital Market Business:

Conclusion:

European Banks backbone is Professionalism in terms of Project Management and their practices with finance/budgeting and other aspects of Projects. Project Management Office is well-versed in the banks of Europe using PMP (Project Management Professional) and PRINCE2 Standards (PRojects IN Controlled Environments). That is the reason, penalties are less in term of banks in European Union then American Banks but even though regulations are tough. Currently due to Sanction countries, plenty of banks are penalized for those transactions which does not passes through, and regulators like European Banking Authority (EBA) and European Central Bank (ECB) are working on these sanction countries and individuals/ corporates to embed in the bank systems.

American Banks are well versed in terms of Technology and principle of Project Management pertaining to Project Management Institute (PMI) and PMBOK© Book of Study which follow strict regulations of Projects. American Banks show interest in Technologies which depend on their country-made products like Microsoft, Google, Intel, AWS, Apple, or few. They do not depend on foreign products/services/softwares to be used in their country, but there are situations which led them to depend on out-sourcing companies in Gulf and Far east Asia to manage their business world-wide as the operational cost is getting higher in the banks. Foreign Banks in America are facing tough situation to sanction countries and AML to flow the transactions from end to end and they have been facing huge penalties from American regulators - Federal Reserve (FED).

Gulf Banks are very good in operation process and documentation, but the systems used are very kind of legacy based and now they are advancing from Manual to Automation in System Operations as well as Project Management Tools. Core-Banking system are some point of automation used by the banks in Gulf region to bring and automate operation activities to remove human interaction between system. There will be more mergers and Acquisitions in the banking area as the operational cost is increasing in banks which could be reason to automate in banking sector to happen in due time. The objective is to reduce Human resource and bring Saudization/Emiratization in their country to enhance their Nationals on major role which is held by other foreign residents.

Research Question and Clarification

Is the Cost makes a major impact on projects? If the answer is “Yes” Cost impacts, then whether over forecasting and budgeting for a project will be retained in the next few years or tight Costing control will be followed to fit project for specific time frame. The question lays as show-stopper for many projects which are running during the current pandemic situation?

As a Project Manager, will be thinking to get extra budget if any new change request is raised by the business user then project sponsor approves it. If there is new project kick-off then spending is moved to the next year 2021 as lot of banks are thinking not to spend money on the current pandemic situation. To the current situation, projects which have started with the last and current year are running smoothly now. The Project Managers will be facing tough situation to handle their clients for future if budgets are not allocated and there are chances to lose critical skilled human resources for the bank as well as in other sectors. Currently, there are no increase in salary obviously so cost cut down in terms of salaries are already in place and there will be more layoff may occur during the end of this year 2020 in absence of those future projects.

Bibliography (standard format of citations according to international standards):

Books References - BookBoon

- Project Management by Prof. Dr. Olaf Passenheim

- Practical Project Management by Mr. Martin VanDerSchouw

- The Project Office as Project Management Support in Complex Environments by Gunnar Widforss and Malin Rosqvist

- Methods for quantitative risks analysis of cost and deadline overruns in complex projects by Paúl Urgilésa*, Juan Clavera and Miguel A. Sebastiána

- Summarization of Software Cost Estimation by Xiaotie Qin and Miao Fang

Web Resources

Web Links

https://www.pmventure.com/enterprise-project-management.html

https://www.clarity365.co.uk/Home/

https://reviews.financesonline.com/p/ca-clarity/

https://www.theprojectgroup.com/en/project-management-tools/microsoft-project-server

https://www.bmc.com/it-solutions/job-scheduling-workload-automation.html

Web Videos

YouTube Videos

https://www.youtube.com/watch?v=8IMUqD4GH7s

https://www.youtube.com/watch?v=2BCg4vN_bCM

https://www.youtube.com/watch?v=GRpKBdDKTDk

https://www.youtube.com/watch?v=ZK4bLYytBf0

Article by Aslam Mohamed Haneef, student of LIGS University