Energy Crisis Impact On The Occupational Health And Safety Management Of The Energy Companies – a new proactive crisis management methodology inspired from the marketing of service

In all OHS management approaches, we will be able to talk about three categories of management, Legal, Socio humanitarian and Financial/Economic.

Introduction

Crises are nowadays an irrefutable reality, in various forms and fields of action, the crises strike more and more deep the international community without advance notice, moreover the interactions between the crises come to complicate more and more the situation.

We are still talking about humanitarian crises, political and economic conflicts, social and societal crises, financial crises and environmental crises.

Several authors describe the crisis of indecision at the time of a disturbance. The presence of an obligation to make quick decisions in response to any problem, the attribution of this urgency is made to interventions, and especially when the system or organization in question is under the influence of a critical problem accompanied internal and external pressures for an indefinite period.

This organization in crisis becomes for a moment the object of unfavorable attentions in the eyes of several speakers; and this is undoubtedly added to the facts of surprises and unpredictability during the realization of the event. Others speak of breaks and imbalances, which are not the only form of destabilization, but also a rupture of the relations between the components of a system in times of crisis. Typology is the study of characteristics in a given datum to determine types or systems.

Recent history records several phenomena of crisis linked to the technological progress we notice in the following some that have clearly marked the History [1].

Table 1: Crises Marking The Humanity Of The 20th Century / 21st Century

|

Crisis |

Industry |

Country |

Date |

|

Titanic |

Transport |

UK |

1927 |

|

Corvair/G.M. |

Cars |

USA |

1965 |

|

Torrey Canyon |

Oil |

Europe |

1967 |

|

Buffalo Creek |

Mining |

USA |

1972 |

|

Amoco Cadix |

Oil |

France/Europe |

1978 |

|

Three-Mile Island |

Nuclear |

USA |

1979 |

|

Mississauga |

Chemical |

Canada |

1979 |

|

DC-10 |

Aviation |

USA/ World |

1979 |

|

Johnson & Johnson |

Pharmaceutical |

USA |

1982 |

|

Nestlé |

Foods |

Africa/ World |

1982 |

|

Seveso |

Chemical |

Suisse |

1982 |

|

Bhopal |

Chemical |

India |

1984 |

|

Continental Illinois |

Banking |

USA |

1984 |

|

Ohio Savings & Loans |

Finance |

USA |

1985 |

|

Challenger |

Aerospace |

USA |

1986 |

|

Braniff |

Transport |

USA |

1986 |

|

Sandoz |

Chemical |

Suisse |

1986 |

|

Chernobyl |

Nuclear |

URSS |

1986 |

|

Wall Street |

Finance |

USA/ World |

1987 |

|

E.F. Hutton |

Finance |

USA/ World |

1987 |

|

Hinsdale |

Telecommunications |

USA |

1988 |

|

St Basile le Grand |

Chemical |

Quebec |

1988 |

|

Exxon Valdez |

Oil |

USA/Alaska |

1989 |

|

Polytechnic University |

University |

Canada / Quebec |

1989 |

|

Perrier |

Food |

France |

1990 |

|

Dow Corning |

Health |

USA/ World |

1991 |

|

L.A. Riot |

Riot |

USA |

1992 |

|

Fire California |

Community |

USA |

1993 |

|

Forest |

Environment |

Canada/ World |

1995 |

|

Morue |

Fishing |

Canada / Quebec |

1995 |

|

Saguenay |

Flood |

Canada / Quebec |

1996 |

|

Black ice |

Environment / Elect. |

Canada / Ontario |

1998 |

|

World Trade Center |

Terrorism |

USA |

2002 |

|

Mad cow / sheep |

Agriculture |

World / Europe |

2000 |

|

BP oil disaster |

Oil |

Gulf of Mexico / USA |

2010 |

|

Fukushima nuclear disaster |

Nuclear |

Japan |

2011 |

|

Oil price collapse |

Oil |

ME / Monde |

2015 |

A comparison between risks and benefits of a technology is always present in the minds of people. There is a tendency to calculate the gains made by new technology and the losses able to cause if the technology proves to be unmanageable or out of control; knowing that a loss of control is possible with a degree of probability of realization of the risk more/less important.

The literature of crises is very rich by the typological interpretations of crises, we can cite certain typologies that interpret crises according to territoriality and divide crises into two main aspects; internal crises and external crises, other interpretations are based on the degree of complexity of the crisis; they distinguish simple crises with monotonous and iterative paces and more complex crises that do not obey a clear and known rhythm.

But the most relevant typological interpretation is that which deals with crises by the aspect of communication; this aspect is very important to know and study; Given the importance of communication in the overall management of crises, the typological interpretation according to the nature of the communication that accompanies it divides the classification of the crisis into four sections: classification by program, classification by immediate causes, classification by root causes and classification by the consequences of a crisis.

Specificities Of The Oil Sector Crisis

Mixing the practice with the theoretical is essential, in a crisis context, crisis management has become a strategic issue for companies, not only to preserve their legitimacy and their sustainability, but also for the well-being of communities, communities and societies. It is certain that crises have serious negative financial consequences for companies; it is also certain that the financial risks are enormous for a crisis to be the cause of the disappearance of a company, the cost of the crisis is enormous; but what is most enormous is the hidden costs of a crisis.

In the oil sector like any other industrial or service sector, the crisis is certainly not lacking, the oil sector is the leading one of all the energy industry tractor in the global economy. Fluctuations in oil and gas prices directly affect all economies in the world without exception, as the price of crude affects all other raw material prices and therefore production costs.

Crude oil is one of the most demanded products in the world. Any fluctuation in oil prices can have a direct and indirect influence on the economies of countries. The instability of crude oil prices forces companies to change their strategic management.

Since crude oil prices act like any other field price, the same price change will depend directly on the quantities supplied on the market. Any massive increase or reduction in crude oil has implications for the world's stock markets. For this reason, the country stock exchanges always closely monitor any movement of oil prices.

Any variation in crude oil also affects other industrial areas. High oil prices generate a reasonable price for energy, which can negatively affect other commercial and trading activities that depend directly or indirectly on it. On the other hand, the producing companies (national and international) will suffer from low prices, the producing countries whose economies are essentially based on crude oil will have significant difficulties. In the short term, the price of crude oil is influenced by many factors such as socio-political events, the position of the financial markets, medium and long-term, the influence of supply and demand.

Many factors influence the fluctuation of crude oil prices around the world, exploration and exploitation methods and other innovative technologies used to increase production, storage, tax changes, socio-political issues, demand and offer.

The Petroleum Crises And The Main Areas Of Strategic Decisions

In a context of falling oil prices since June 2014, the hydrocarbon sector is undergoing a deep wave of restructuring affecting all players in the various sectors of activity. The sharp decline in investment by large international companies at the beginning of 2015 reflects the deep change observed in the world oil market. This movement is accompanied by the removal of thousands of jobs in service companies.

During the 2000s, the hydrocarbons sector experienced a significant increase in costs, reflecting in particular the average doubling of raw material prices between 2004 and 2008. In addition, the material cost inflation of the projects was accompanied by a strengthening of the difficulties of access to the deposits following a resumption of the nationalization of oil and a growing complexity of the projects, requiring the use of expensive technologies.

The realization of projects is itself increasingly constrained by external regulations (environment, security, etc.) or by local content policies. This group of factors has changed some of the structural characteristics of the sector, including the trade-offs between internal and external growth strategies (Union / Merger and Acquisition transactions).

In a context of low oil prices, inactive demand and pressure from their shareholders, oil companies are accelerating their change of new economic model. Penalized by declining incomes and growing indebtedness, the oil majors have all committed themselves to drastically reduce their investments, to refocus on the most profitable segments of their business, but also to diversify towards other sources of energy.

Cost Reduction Processes And Impacts On Ohs Management

The strategy of cost reduction poses a major problem for the companies of the oil sector as for their mode of operation, the reduction of the costs affects all the economic disciplines, more specifically the energy sector in all its branches, the exploration of new wells, the operation of new and old wells; development and restructuring of crude oil production and processing stations; construction of new stations for development, degassing and refining purposes; and final marketing of refined products.

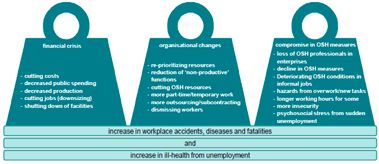

The economic and financial impact also extends to the reduction of jobs, the reduction of wages, the reduction of subcontracts and the growing difficulty of having traditionally stable and predictable market shares. Everything was based and mainly generated by the financial component, the loop then hit the socio-humanitarian component and then touched the legal and political component. Like the global financial crisis of 2008, the graph below clearly shows the effects and impacts of a crisis on the financial, organizational (socio-humanitarian) as well as legal and technical aspects not respected.

Figure 1: The Financial Crisis And Its Potential Impacts On OHS. [2]

In order to explain the effects of the oil crisis on the management of health and safety at work, we must certainly emphasize this type of management in general and its specificity with the oil companies.

OSH approaches vary considerably at all levels of management and can be categorized as purely legal, socio-humanitarian or financial and economic.

- Legal: Respect the law only, compliance with the requirements of the law should be the minimum that a company should achieve. A company that manages health and safety, simply because the law says it, misses out on the many opportunities available to it by trying to do more than just meet the minimum legal standards.

- Socio-humanitarian: taking into account aspects of human resources; individuals and the human being in general takes on considerable importance in this approach.

The moral approach can be explained by the fact that poor health and safety management could affect the reputation. Employers have a duty of due diligence to people and the environment.

- Financial and economic: all incidents of accidents and poor health management of workers are expensive. Most institutions are adept at calculating health and safety costs, such as individual and collective protection, control of workers' health and, most importantly, safety and security training for staff.

The central problem is the search for solutions to direct impacts on the management of the OHS mix, these questions are formed as follows:

- What kind of impact do we have on the socio-humanitarian component?

- What kind of impact do we have on the legal and regulatory component?

- What kind of impact do we have on the economic and financial component?

The idea is to provide a mythology that allows us to solve the crisis, in our case, the crisis is reflected in the unpredictable impact on the components of the occupational health and safety OHS management, financial / economic, socio-humanitarian and also the legal component.

Service Marketing And Crisis Resolution Methodology

Service marketing provides us with a forecasting methodology that we can use in predicting stakeholder reactions to the crisis. In service marketing, the problem is to anticipate customer reactions to a new product or service before it is even launched on the market. What is changing in our case of crisis is to anticipate the reactions of the stakeholders of a crisis vis-à-vis actions and communications to be made to the decision-makers of a crisis before even launching them, this aims to minimize the gaps between what is expected by the stakeholders of a crisis and what is announced by the decision-makers.

Based on a responsive marketing approach that responds to customer demand, we highlight the role of demand-driven marketing in understanding customer needs to speak the same language as customers and satisfy the market.

What interests us the most in this approach is the production of data, which is also a phase of research and reflection, Data collection and retrieval techniques allow producers to anticipate the reactions of customers even before the newly created product is launched in the target market.

The main objective of these forecasts is to speak of the same frequencies as the market; create a new product that meets market demand; satisfy the market and target customers. This will allow the supplier or producer to minimize the gap between the customer and what is expected by the customer. Alongside this marketing approach (H. Renaudin 2005) has established a state of reconciliation with crisis management.

In crisis situations, decision-makers are faced with decisions to take preventive or remedial action. These decisions must be communicated to crisis actors, such as the media; public opinion; I am not sure if this is the case.

The problem for decision makers is important at this stage; There are some questions: is there at least one specific criterion or proven method that ensures the reliability of the decisions to be made? can policymakers decide and act without fear that their decision will disrupt or aggravate the crisis rather than remedy the problem?

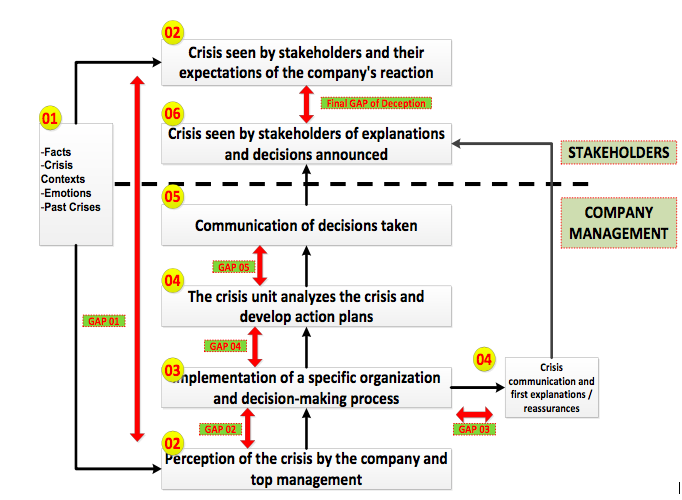

Figure 2: Stakeholder Dissatisfaction With The Crisis [3]

In this diagram (H. Renaudin) explains the presence of five criteria of non-qualities, these criteria are only shifts in perceptions and communications that form a global shift in the quality of the crisis.

This global difference is only a final disappointment; It is not surprising that corporate decision makers are not the only ones who want to make a decision on the crisis.

Gap n ° 1: This gap expresses the natural and global difference between two different visions of a crisis.

Gap n ° 2: This gap is the first component of the global gap, which is small in the internal organization of the crisis and poor planning of decision-making. strictly structural order.

Gap n ° 3: The third gap is an internal dysfunction of the communication service of the crisis, this service expresses poorly these first speeches for the public; This does not explain the decision of the company to the stakeholders of the crisis.

Gap n ° 4: The fact that there is an internal structural disorganization at the level of the crisis. This dysfunction leads to the development of decisions and the application of erroneous actions.

Gap n ° 5: This gap expresses on the one hand a dysfunction between the decisions and the actions of the decision-making staff of the company and on the other hand the communication of the solutions to the stakeholders and the general public.

The last gap is that which differentiates the perception of the solution by the crisis on the one hand and their perceptions by stakeholders and public opinion in general.

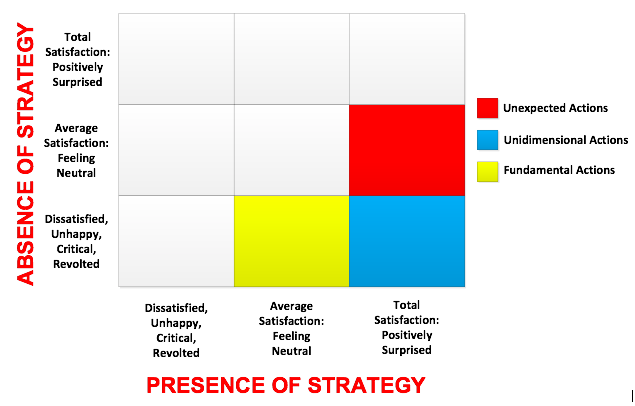

This diagram explains the different levels of satisfaction of the actors of the crisis with the decisions and solutions put in place by the company, while taking into account the effect on the satisfaction in case of application or non-application of the strategies.

Figure 3 : The Satisfaction Matrix Of Stakeholders

At this level it is necessary to know in advance the points of view of the stakeholders; It is important to note that the general public may not be willing to pay for such a measure.

Author: TAHA GHORBEL

Co-author: Dr. Vladimir Biruk

Bibliography (standard format of citations according to international standards):

1. Amable (B). (R) Barré. (R)Boyer. (1997)Les systèmes d’innovation à l’ère de la globalisation. Economica. Paris. pp68-70.

2. Association Française du Développement / Groupe URD. (6 Juin 1999). Planète de toutes les crises : typologie des crises. Journée de formation & réflexion. Availble on site. www.AFD.fr

3. Brigitte Fournier. (1993). L’entreprise en Etat de choc : gérer les crises économiques et sociales et faire face aux médias. Partie 1 : typologie et classification des crises. Éditions de l'environnement. Pp 88-98.

4. Charles D. Reese (2008), Occupational Health and Safety Management: A Practical Approach, Second Edition Hardcover, P 23, 24.

5. Christophe Roux-Dufort. (2000). La gestion de crise : un enjeu stratégique pour les organisations. De Boeck & Larcier. Pp9,10.

6. Christophe Roux-Dufort. Marie Nôelle Sicard. Interprétation par Thierry Libaert. (Décembre 2004). Crises ; De 10 à 100. Le magasine de la communication de crise et sensible–crises. Availble on site. www.communication-sensible.com.

7. Claude Fiore. (2006).Supply chain en action - stratégie, logistique et service clients. Guide marketing. Pp 22,23.

8. CNBC, Challenger, Gray & Christmas- September 2015 Data.

9. Dictionnaire Encyclopédique. (2001). Larousse.

10. Economic downturns and population mental health: research findings, gaps, challenges and priorities, K. Zivin, Ph.D., Department of Psychiatry, University of Michigan USA. 2011.

11. Gérard Lagneau. (9/05/2001). La part de l'image dans la valeur de l'entreprise. Les Echos. Article N°10. Article N°10 - p95.

12. GESTION DE CRISES, Mode D’emploi : Herve RENAUDIN / Alice ALTEMAIRE: liaison éditions 2007. PP 115-118.

13. Gilles Guerien-Talpin. Francis Grass. Michel Ogrizek. Interprétation par Thierry Libaert. (Décembre 2004). Crises ; De 10 à 100. Le magasine de la communication de crise et sensible–crises. Disponible sur le site. www.communication- sensible.com.

14. H. Renaudin, Sortir D’une Crise : Une Approche Par Le Marketing Des Services, 2005, adapté d’A.Kano.

15. Herve Renaudin. (Février 2005). Sortir de la crise : une approche par le marketing des services. Le magasine de la communication de crise et sensible. Availble on site. www.communication-sensible.com.

16. INSEE - L'Institut national de la statistique et des études économiques- France.

17. Institut des hautes études de la défense nationale française. (Janvier 2002). Actions militaires et gestion des crises. Rapport de 1ère phase ; 54ème session nationale ; comité 2. Pp13–15.

18. Interpretation By : Causes et conséquences de la chute des prix du pétrole, Guillaume A. Callonico, Geoplitics Expert - 04 February 2016. http://monde68.brebeuf.qc.ca.

19. IOSH Managing safely, Trainer notes: modules 1-4. P.P.15-16.

20. Jérôme Sabathier. Manuscrit juin 2016 - En réponse au contre-choc pétrolier, la stratégie en trois étapes des majors pétroliers : désendettement, désinvestissement et diversification.

21. Le marché du pétrole : fonctionnement, évolution des prix, effets pour l’économie Française - esjouvet.wordpress.com,

22. Les 5 sources de non qualité de gestion de la crise par l’entreprise (H.Renaudin, 2005).

23. Les effets d'un prix du pétrole élevé et volatil - Rapport - Patrick Artus, Antoine d’Autume, Philippe Chalmin et Jean-Marie Chevalier. Direction de l’information légale et administrative. Paris, 2010. P.P.26-41.

24. Marie-Hélène West Phuller. Eveline Gasquet. Interprétation par Libaert Thierry. (Décembre 2004). Crises ; De 10 à 100. Le magasine de la communication de crise et sensible–crises. Availble on site. www.communication-sensible.com.

25. Occupational Health Psychology - Edited by James Campbell Quick and Lois E. Tetrick - American Psychological Association Washington DC - 2001.

26. OEDC : Organization for Economic Co-operation and Development - 35 member countries, founded in 1960 to stimulate economic progress and world trade.

27. Oil Market Intelligence et NATIXIS

28. OIL TITANS National Oil Companies in the Middle East, VALÉRIE MARCEL, John V. Mitchell - CHATHAM HOUSE London, BROOKINGS INSTITUTION PRESS - Washington, D.C. 2006. National Oil Company Structures P.P. 277-282.

29. Oleg Curbatov. (2003). L’intégration du consommateur par le knowledge marketing – conception, production et consommation d’un produit personnel. UNIVERSITÉ DE NICE-SOPHIA ANTIPOLIS : Institut d’Administration des Entreprises. Thèse Pour Le Doctorat En Sciences de gestion. Pp 37- 41.

30. PANORAMA Articles : Le retour des fusions et acquisitions dans le secteur des hydrocarbures, 2016.

31. Patrik Lagadec. Michael Regester. Interprétation par Thierry Libaert. (Décembre 2004). Crises ; De 10 à 100. Le magasine de la communication de crise et sensible–crises. Disponible sur le site. www.communication-sensible.com. Consulté le 21/08/2006. pp.5 ; 6.

32. Patrick Legadec. (1993). La cellule de crise: les conditions d’une conduite efficace. Ediscience, Paris. Pp 65-66.

33. Patrick Legadec. (Mars1991). La gestion des crises : Outil de réflexion à l’usage des décideurs. MCGRAW-HILL. pp138- 149.

34. Petroleum Finance Company (PFC), S

[1] Association Française du Développement / Groupe URD. (6 Juin 1999). Planète de toutes les crises : typologie des crises. Journée de formation & réflexion. Availble on site. www.AFD.fr

[2] Workers’ health and safety exposed to crisis, benchmarking 2014 -ILO 2014. P. 2.

[3] Les 5 sources de non qualité de gestion de la crise par l’entreprise (H.Renaudin, 2005).