The Covid19 Pandemic Puts Traditional Banks in a Triangular Risk Impact Position

TheCovid19 Pandemic has created a business environment in which the Traditional Banks have been encapsulated with various risks on three fronts, namely: the social-economic front, digital transformation front, and demand landscape front. This scenario is explained by a Theoretical Triangular Risk Frameworkstated in the introduction of this paper. Each front has inherent risks facing the banks. The purpose of this paper is, therefore, to create awareness in the banking industry about this stealth negative situation facing banks due to the pandemic. The framework generally provides strategic direction for banks on risk management. For the academia, the theoretical framework is a developing tool that is likely to stand for the foreseeable future.

Research question:

How have risks created by covid19 pandemic affected the traditional banks?

INTRODUCTION

General Background Scenario

As the center for financial services, the banking industry is a crucial component of economic and social activities. The banking industry is the engine of economic and social development because it provides savings and credit services to individuals, companies, and organizations. Banks provide and control the supply of money in the economy to facilitate financial transactions and trade. For banks to operate effectively and achieve these functions, there must be stability in the social and economic environment. Therefore, the relationship between the banks and the social-economic environment is reciprocal. The impact of the Covid19 pandemic has disrupted the stability in the social-economic environment the world over. Consequently, the banking industry faces a cornucopia of risks in this environment.

Figure 1:

Representation Image of Covid19 Masked People Globally

Source: Visuals-OPRf107B Lek-unsplash

Social-economic Environment

Before the outbreak of the covid19 pandemic, there was a global economic slump, and banks were facing low-interest rates. Banks also experienced increased regulatory controls and supervision, which intensified yearly. Banks faced stiff competition in digitalization from shadow banks and digital challenger banks on banking services delivery that challenged the foundations of traditional banking models. The 2007 – 2009 financial crisis engulfed the banking industry and provoked intense regulatory controls worldwide. More stringent capital adequacy and risk management regulations increased prudential requirements and regulatory scrutiny. Consequently, banks faced regulatory compliance risk in many facets, adversely affecting banks' operational costs.

Digital Transformation

Historically, it has been the banks‘ tradition to provide banking products on the market and encourage consumers to access the products through advertisements and marketing initiatives. This is product-centric approach which has been deeply inculcated in traditional banks' banking models (OECD, 2020). The approach saw traditional banks build large physical infrastructures to deliver their products. Their IT technology too was developed based on and to support product-centric delivery models. However, the advent of digitalization of banking services by FinTechs took a new turn where the focus was on the customers' demands, providing financial solutions to customers‘ services needs. This approach is the customer-centric approach to delivering banking services, which Big-Techs too, have adopted to deliver banking services. Consumers have overwhelmingly embraced the digitalized banking services. The FinTechs and the BigTechs have dominated the banking market, creating stiff competition for the traditional banks. Based on the product-centric approach, traditional banking models have gradually become irrelevant to the modern market needs. This state of affairs forced the incumbents to begin transforming to digitalized services, but at a slow pace. The incumbents' digital transformation has been in peripheral sections of banking and, to a large extent, it has been an automation of individual bank products into digital format. This approach did not give customers the expected convenience and experience. The other challenge incumbents face in the digital transformation, is the limitation in their legacy architectural systems, which are not compatible with digital systems. Most banking digital transformation is, therefore, done through interfaces and is riddled with errors and bugs, making delivery of services slow and inefficient. This scenario has made the FinTechs and BigTech'sdigital banking services more preferred as their systems are without legacy impediments and are based on modern digital technology. When Covid19 hit all corners of the world, the incumbents realized that they had to speed up their digital transformation to meet the covid19 prevention demands. This approach meant implementing digital systems in banking operations without proper evaluation and verification of digital apps. Consequently, these circumstances exposed banks to a cornucopia of risks on the digital transformation front in the covid19 era.

Demand Landscape

Digital technology came about three decades ago. During this period, the generational fabric of the world was also changing. The millennials and generation Z were entering the corporate world and the markets creating age diversity of consumers in the markets (Xu et al. 2016). The baby boomers dominated both the corporate world and the markets. Baby boomers and millennials influenced the corporate world and the markets, but differently (Baba, 2019). Boomers preferred traditional banking services while the millennials preferred digital banking services. The change affected the banking industry on services demands. The millennial cohort was born between 1980 and 2000. They were born into digital technology, growing up with social media and smartphones, hence are called the tech natives, the narcissistic tech gurus, the smartphone natives whose technology literacy levels, are at the cutting edge of the upper-tier (Rayback, 2016).

Conversely, baby boomers were born between 1946 and 1964 (Balancecareers, 2018). Boomers were born and grew up during the time the only advanced technology were the inventions of television, the ground telephone, and the radio. Therefore, boomers' tech levels are placed on the lower middle tier, just enough to enable them to navigate smartphone menus (Rayback, 2016). The millennials took the markets by storm, demanding every product and service to be accessed through the smartphone. The consumer market revolution, which is now predominantly digital, has also engulfed the financial market including the banking market. The FinTechs and Big-Techs are the major players on the market, and are the drivers of the digital revolution, which continues to transform the world economy into a digital economy. It is a demand-driven revolution at the behest of millennials and generation z demands. These forces compelled market structures to change to digital, where smartphones have become the standard way of accessing products and services. The FinTechs and BigTechs have dominated this market with digital products and services which have surpassed the incumbents' services. When Covid19 hit all corners of the world, the demand for digital-based banking services increased unexpectedly within a short time, forcing banks to comply under emergency circumstances. The continued existence of covid19 has, therefore, changed the demand landscape of banking services from predominantly branch-based to online and mobile-based. The changing demand landscape has exposed the incumbents to a broad spectrum of risks, including model risk, operational risk, reputational risk, market risk, social risk, cybersecurity risk, tech disruption risk, infrastructure risk, money laundering risk, and strategic risk risks.

Figure 2:

Empty Shopping Streets Due to Covid19 Pandemic

Source: dan-burton-IBleyHyU-RE-unsplash

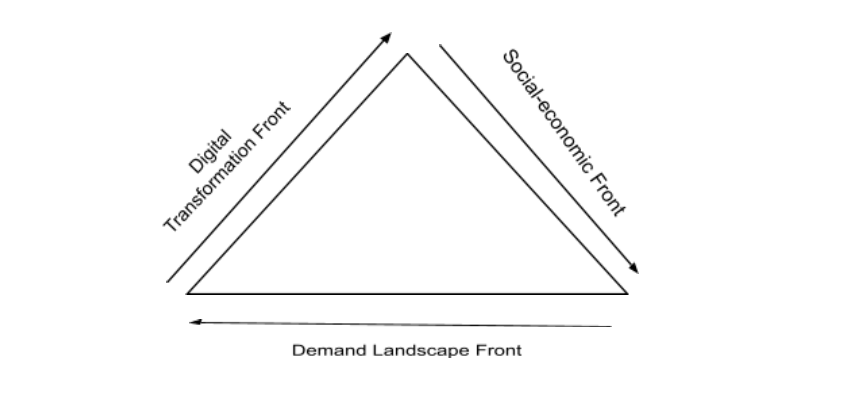

Theoretical Triangular Risk Framework

The Covod19 impact on the world economy has affected every sector of social and economic activities. The traditional banks’ business environment was equally affected, mainly on three fronts, namely: Social-economic, Digital transformation, and Demand landscape, all of which have encapsulated the traditional banks into a position where they now face triangular impacts of various risks coming from these fronts. This framework depicts incumbent banks exposed to a cocktail of risks in their daily operations from the three sides of the framework. The pandemic environment has concentrated various risks on these fronts, which are the critical touchpoints of incumbent's business operations. Banks' management needs to be aware of this covert situation hovering over traditional banks and be prepared to deal with the situation. Knowledge of the framework is vital for strategy formulation for the banks' risk management.

Figure 3

Theoretical Triangular Risk Framework

The author of this paper created the theoretical triangular framework of risks to depict the three fronts that have encapsulated traditional banks due to covid19 conditions. Namely, the fronts are digital transformation, the social-economic environment, and the demand landscape. They are correlated, and each front has inherent risks impacting traditional banks' business in the covid19 pandemic environment.

The main research question in this study is: How have risks created by covid19 pandemic affected the banks? This research question is supported by the following minor questions:

- Is there a triangular risk impact position encapsulating incumbent banks due to covid19 created conditions?

- What are the names of the three fronts?

- How correlated are the three fronts?

Each front has inherent risks that the incumbents encounter in their daily operations. Some risks are found in more than one front.

Under the Social-economic front, banks are likely to encounter: credit risk through non-performing loans (NPLs). The lockdowns slowed the production of goods and services, reducing sales, creating layoffs, and reducing working hours in companies and organizations. As a result, some borrowers unable service their facilities as planned. Banks with proportionally bigger loan books than deposits are likely to face liquidity risk. The operational risk could also arise as lockdowns reduce staff levels that would negatively impact processes and procedures, fraud control, and prevention.

From the Digital Transformationfront, banks face cybersecurity risks, online fraud risks, and the risk of customers' data exposure through the service platforms and open banking. The risk of technology disruption from FinTechs and BigTechs is imminent as online banking services are in high demand to prevent human contact. The massive banks' physical infrastructure is becoming redundant, creating infrastructure risk where digital services are in demand.

The pandemic has created a changed demand landscape for banks. On this front, banks face model risk as traditional models have become irrelevant and burdensome to the market. This development mounts intense pressure on the incumbents to digitalize, creating strategy risk, cyber security risk, and reputational risk. Banks had to change banking models under emergency circumstances to meet demand in the covid19 demand landscape (Caretti et al., 2020). This development led to closures of many bank branches and staff working from their homes, forcing banks to redesign their processes and procedures overnight, giving no ample time for testing the systems (Oliver Wyman. 2021). Such a scenario created an operational risk of significant proportions. Banks are under immense pressure to deliver services on mobile devices, exposing them to the risk of choosing the appropriate digital banking apps to buy. Banks have to continually assess their security software and replace outdated apps in the same vein. This situation exposes them to the risk of using outdated apps, exposing banks to cyber security risks and, ultimately, to reputation risk. Digital talent transformation to meet market demands is yet another risk facing the banks on this front. Training and reskillimg existing staff cannot be done overnight.

Consequently, the delivery of services will suffer. Banks had to implement teleworking processes, which exposed management and staff to the risk of mental stress. Monitoring and controlling teleworking requires new administrative and technological infrastructure and skills. Such an exercise could not happen in a short period. Therefore, banks faced massive digital talent risk to transform legacy banking models.

Therefore, this paper aims to create awareness about the stealth position the incumbents are in due to the covid19 pandemic environment. The incumbents need to have strategies how they intend to deal with these risks in their operations. The solutions to control, mitigate, or eliminate these risks will be on individual bank bases depending on the level of digital transformation of the bank. It cannot be one size fits all approach. The starting point would be reviewing and upgrading Risk Management (RM) and Business Continuity Management (BCM) guidelines. The theoretical framework is vital in strategy formulation.

RESEARCH METHODOLOGY

In the prevailing covid19 pandemic environment, this study chose to apply the secondary data research methodology to gather the requisite data for analysis. As cited in the International Journal (2012) on Grounded Theory Review, secondary data analysis uses previously collected data for some other purpose to generate new ideas. As a general theory, grounded theory adapts readily to studies of diverse phenomena (Temple University Libraries, 2022). One of the reasons researchers have been using secondary data analysis as a data collection method is to re-analyze the data from a new perspective to gain new insights(Grounded Theory Review- International Journal, 2012). In any case, 'all is data' as proclaimed by Glaser's dictum (Tie et al., 2019). Secondary data is extant data. "Grounded theory provides a methodology to understand social phenomena that are not pre-formed or pre-theoretically developed with existing theories and paradigms." (Engward, 2013, Nursing standard, 28, 7, 37-41). The advantages of using secondary data far outweigh its disadvantages, and in the current coronavirus environment, it has become the necessary method. A review of the vast quantity of secondary data was undertaken to select relevant literature. Electronic research was done on the internet from highly reliable online scholarly libraries. The research works by various researchers and scholars on the development and impact of covid19 concerning the general social-economic status globally, digital transformation in the financial sector, and the general consumers demand landscape development were reviewed, evaluated, and relevant material selected to form part of this article. Secondary data analysis can interpret data from primary research to provide some insights into general trends in an industry or product category. Secondary data may help identify the problem and help better to define the problem (Mora, 2022). The main objective of undertaking a desk review of electronic literature was to gain a comprehensive knowledge of the area of study by going through various articles with varying approaches on the subject, researched by different researchers and scholars. This approach enabled the author of this paper to evaluate the materials from a wide range of sources and expertise on the subject. Independent opinions from the well-informed departure of knowledge were, therefore, made. Relevant arguments have been put forward on the gaps and challenges noted in the materials reviewed, and proposals and recommendations believed to address the gaps have been made in this paper.

LITERATURE REVIEW

Background and Historical Review of Banking

Traditional banking models were built over almost a century, beginning from the medieval time when banking evolved from goldsmiths to when gold eventually was used as a store of value and medium of exchange. Banking evolved from the business of goldsmiths, who, besides making gold coins, were also trusted with the safekeeping of gold bars for the public. This evolution turned into a revolution when hoarding gold bars superseded the business of making gold coins. In other words, people demanded hoarding gold with the goldsmiths more than the service of making gold coins. Why did people choose to keep their gold with goldsmiths? As manufacturers of gold products, goldsmiths built fortified warehouses where gold was safely kept. Eventually, people with gold chose to keep their gold with the goldsmith for safety. This accelerated gold as a medium of exchange upon which the goldsmiths started issuing transfer notes of title to gold owners instead of physically transferring gold from one person to another when payment through gold was made. This development was the birth of banking and the demise of the gold coins-making business. As goldsmiths received large deposits of gold for safekeeping, more fortified buildings for keeping gold came up around the world, which eventually became banks.

Therefore, banks services delivery systems and models have evolved with the demands of the time, from the medieval system of goldsmiths to manual processes based on paper records, to automated processes done on accounting machines, to processes done on information communications technologies (ICT), to the current processes done on digital technologies. Demand has driven the banking industry from medieval times to where it is today, and the evolution of banking through demand continues.

Similarly, digitalization in financial services through the FinTech revolution has transformed the demand for banking services from traditional branch-based services to digital-based services using desktops, laptops, tablets, and smartphones. Today people prefer accessing banking services through the smartphone than visiting a bank branch. People prefer digital cashless payments to cash payments. “Banking is necessary, banks are not…” (Gates, 1994). The advent of digital technologies has created a paradigm shift in the delivery of banking services, which the banking services consumers have overwhelmingly embraced. However, digital transformation in traditional banks was going at a slow pace. The most significant impediment was the incumbents' legacy systems and physical and administrative infrastructures. Therefore, it is not a simple exercise to replace them with digital infrastructures. Banks’ digital transformation has been through peripheral digital transformation in which chains of interface software are used to link non-digital to digital format data. Despite the competition from FinTechs and Big-Techs, the incumbents were in no hurry to digitalize their banking operations fully.

On 11 March 2020, the World Health Organization declared Covid19 as a pandemic (Sanchez, 2021). This declaration was the turning point of the world's social-economic equilibrium as the world resorted to face masks, hands sanitizing, social distancing, teleworking and isolation, businesses lockdown, transport sector lockdown, and finally, countries lockdowns to prevent human contact and the spread of the virus. This development created simultaneous disruptions to the supply and demand of things in the interconnected world economy on the macroeconomic level. The pandemic reduced labor supply and productivity from the supply side of things. Businesses operated at reduced capacities, and in some cases, complete closures occurred, causing supply disruptions (Chudik et al., 2020). On the demand side of things, staff manning levels were reduced in every industry, and in some cases, layoffs occurred—industries that were hit the most included art, entertainment, hospitality, transport and food. There was a general loss of income for both individuals and businesses as consumption at the household level reduced. It was an economic and social crisis never seen before. How did this state of affairs affect the banking industry?

Figure 4:

Traditional Bank Physical Infrastructure

Source: IndeBank-Malawi

Pre-covid19 Social-economic Environment and Inherent Risks

The pre-covid19 era has been lukewarm for the banking industry regarding the nature of risks they faced. The social-economic environment was very much influenced by the American/China and European trade wars propagated by President Trump. The threats of tariffs imposed against China and Europe by the United States impacted business prospects for many companies (Buccella, 2021). This resultant atmosphere posed political risk and uncertainty for the banking industry and all economic and social sectors.

As the Financial Industry was still reeling from the strict controls of the 2008 financial crisis, which banks caused, talking to the bank executives in 2018, the research by the Resolver revealed that there was worldwide economic stagnation, whether one is focusing on Europe, China, Japan or the United States (Buccella, 2021). "Banks will continue to focus further on compression of interest margin due to the federal reserve strategy of keeping interest rates low or near zero for the next year-plus, given the nature of the economy," said Ryan Luttenton, the consulting partner at Crowe, which ABA endorses for risk, compliance, and governance consulting (Knudson, 2021). Therefore, a low-interest wave in all financial jurisdictions adversely affected banks' credit business. The pre-covid19 economic environment for banks was characterized by low-interest rates risk, which squeezed banks’ profits.

The pre-covid19 journey has been a rough ride for the incumbents in terms of the digitalization of the banking industry. Before the pandemic, the banking industry was already digitalizing its operations, compelled by consumers’ demands, competition among the incumbents themselves on digitalization, and competition from new challenger banks. This scenario exposed the industry to cyberattacks risk through massive connectivity. The banks also faced business disruption risk from the BigTech companies like Amazon, Apple pay, AliPay, and many other companies conducting banking as a service (BaaS). Through Open Banking and PSD2 regulatory banking models, banks are obliged to allow third parties to access banks' data through API systems. This practice exposed banks to fraud, phishing, cyberattacks, and data protection risks. Failure to innovate to the standard of FinTechs exposed the incumbents to reputation risks, strategy risks, and operational risks. While banks undertook digital transformation, they did not sufficiently train and upskill their staff to support the digital systems. Consequently, they relied on outsourcing digital support services. This approach exposed them to outsourcing, third-party dependency, and data protection risks.

The 2008 financial crisis engulfed the banking sector, ultimately provoked more regulatory and legislative controls on banking operations. Thus the banking industry was over-burdened by regulations in the pre-covid19 time. For example, Dodd-Frank Wall Street Reform and Consumer Protection Act passed in 2010 significantly impacted business operations in banks (Buccella, 2021). This exposed banks to compliance and legal risks. In conclusion, before the pandemic, banks faced credit, liquidity, operational, interest rate, market, valuation, solvency, legal, conduct, and strategic risks.

Covid19 Social-economic Environment and Inherent Risks

The outbreak of Covid19, which began in China, spread worldwide with unprecedented speed. It created global health crisis never seen before that brought the entire world to its knees in a short time. Covid19 created an emergency state of affairs in every sector of the country’s social and economic environments, and it did not matter whether it was a developed economy like the UK and the US or under-developed sub-Saharan countries in Africa. The catastrophic impact of the disease was the same, and they all faced similar problems in containing the pandemic (Shrestha et al., 2020). The health crisis turned into a global social-economic crisis of unprecedented magnitude. For the first time in the human race, the world was brought together, “in our interdependent world, no one is safe until everybody is safe” (UNHCR, 2021) became the buzz phrase.

Figure 5:

Global Spread of Covid19 Virus

Source: Giacomo-carra-gf6UDwpl0ac-unsplash

Ultimately, wearing face masks, hand sanitizing, social distancing, and cities and countries lockdowns became mandatory the world over to stop spreading the virus. These interventions created serious and unprecedented social problems in people's daily lives. Micro and macro-economic activities became subdued, and economies in all jurisdictions slowed as companies scaled down operations and some closed. Businesses that depend much on physical human contacts like hospitality, air and sea travel, shopping centers, restaurants, tourism, schools, churches, banks, and financial institutions reduced services to the lowest level or closed. The developing situation resulted in unprecedented unemployment levels the world over. Production of commodities and services drastically dwindled except in health-related industries. The supply of goods and services dwindled, and demand for goods and services in industries like hospitality, food, travel, and schools reduced almost to zero as consumers remained indoors. The shares of companies in such industries slumped. As little was still known about the virus and how it can be controlled socially, such a situation created global uncertainty. Fake news and conspiracy theories flooded social media and effectively grew fast and ubiquitous, exploiting public fear and uncertainty of the pandemic (PwC 2020a, p.1). In some societies, people got misled even further, creating a lot of anxiety and hopelessness as to refuse vaccines and / or go to hospitals when ill. In extreme cases, some people disregarded wearing face masks, social distancing, and vehemently opposed lockdowns. This social crisis shook the foundation of every family institution regardless of race, skin color, society, and class. How did covid19 impact businesses generally?

The implementation of lockdowns adopted by many countries globally to arrest the spread of the coronavirus changed the way consumers accessed goods and services around the world. Shopping for goods and services online has become the recommended method (Pinzaru, Zbuchea, &Anghel, 2020). Consequently, e-commerce shopping became no longer an option, as was the case in the pre-covid19 era, but the standard and appropriate method of shopping in the covid19 era (Marcu, 2021). Table 1 below gives a bird’s eye view of the position of e-commerce as people and firms responded to covid19 control measures around the globe.

Table 1:

Online Retail Sales, selected Economies Globally, 2018-2020

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Source: UNCTAD, based on national statistics offices

The dramatic rise in e-commerce amid movement restrictions induced by covid19 increased online retail sales share of the total retail sales from 16% to 19% in 2020, according to estimates in a UNCTAD report published on 3 May 2021 (UNCTAD, 2021). Korea had the highest online share, from 20.8% to 25.9%. Looking at the overall average share for these economies, from 16% to 19%, it is a significant change considering that the virus was first reported on 31 December 2019. Companies such as Alibaba, Amazon, Shopify, eBay, Apple, Microsoft, and Walmart were already ahead of virtual trading when covid19 came. Services of e-shopping and online sales increased, with Alibaba topping the list. By forcing consumers to remain indoors, the covid19 circumstances accelerated retail trading transactions to go digital (Mattia, 2021). Companies that were already in the e-commerce business benefited from increased sales. Table 2 below depicts companies in e-commerce before the pandemic and has now become part of the solution to the pandemic's devastating impact on the human race.

Table 2:

Top B2C E-commerce Companies by GMV, 2020

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Source: UNCTAD based on company reports

Note: Alibaba year beginning 1 April, Walmart year beginning 1 February. Figures in italics are estimates. GMV = Gross Merchandize Value (as well as Booking Value).

Looking at the statistics in Table 2 above, not all e-commerce business companies before the pandemic benefited from the lockdowns. US companies like Uber, Expedia, Booking Holdings, Airbnb, and a Japan's firm, Rakuten, their sales dwindled, and they lost their world positions of pre-covid19. Such development could expose banks to credit risk if these companies borrowed on expectations, which to all intents and purposes, anyone would agree.

However, the slowdown in production resulted from companies' adoption of covid19 preventive measures, the supply side dwindled, and people scrambled for things like toilet paper. Lockdowns also culminated in the tremendous increase in poverty and social inequality in almost all economic jurisdictions, such as Eastern and Southern Europe and Northern and Central Europe (Palomino et al., 2020). To alleviate suffering, governments paid out cash to vulnerable families and those that lost their employment due to covid19. Through central banks, governments also issued moratoria on banks for loan interest accruals and repayments to lessen financial burdens on both individuals and firms that borrowed from banks. How did this crisis impact the banking industry?

In the previous crises of 1930 and 2008 that culminated in the world’s economic meltdown, the banks were part of the problem. In the covid19 crisis, banks are not part of the problem but part of the solution (Macru, 2021). The issuing of moratoria on banks to postpone loan repayments is part of the solution banks executed by governments decree to alleviate financial burdens on people servicing loans like house mortgages but were now on half-pay, or indeed, unemployed due to covid19 lockdowns (Disemadi et al., 2020). Firms, too, benefited from moratoria due to the scaling down of operations; their expected revenues per month went down, making them unable to service their borrowings from banks (Barua et al., 2021). However, the moratoria exposed banks to liquidity, credit, and compliance risks, which made banks fail to comply with regulatory capital adequacy benchmarks. This development also caused banks' stocks to crash on the stock market (Acharya et al. 2021), creating volatility risk for the banks. Governments, through central banks, provided liquidity support to banks and averted these risks, including public guarantee schemes on bank loans ("PGS," amounting to €381billion in the first quarter of 2021), most of which went to a few Member States in the EU (Resti et al., 20121).This strategy kept the banks afloat and able to continue proving credit to entrepreneurs and individuals. For example, the German government provided liquidity support to its commercial banks to enable them also support businesses and individuals with credit facilities during the civid19 period (Funke et al., 2020)

The increase and prolongations of lockdowns compelled companies to implement a telework system where some staff worked from home. This practice also increased online shopping as people could not go out shopping. The ultimate consequence of teleworking and e-shopping is that values for real estate went down. Banks that took collateral on their lending to entrepreneurs and companies face risks of holding under-valued securities. In the event of default, the realized value would not cover the exposure. Thus teleworking has enhanced credit risk for banks.

In summary, the preceding scenario created by the pandemic has exposed banks directly and indirectly to many risks. Banks faced low-interest rates risk before the pandemic due to the shrinking of the world economy. The pandemic has made this situation worse by lockdowns, and in some jurisdictions, interest rates have been reduced further during the pandemic period to encourage companies to increase production and uplift industries like hospitality, food, transport, and tourism. Central banks across the global reduced interest rates 207 times during the pandemic period to boost economies (AA, 2021). It implies further squeezed margins for banks and reduced revenues and exposes banks to solvency risks in the long term. As most countries are opening up from the lockdowns, companies are regaining their total production capacity. This development is creating more demand for credit.

As a result, banks could expose themselves to credit risk if no proper appraisal is done to grow the loan book. Banks could face liquidity risks with the loan repayments moratorium still in force. The world is not yet out of the woods of covid19, and most companies and organizations are still engaged in teleworking functions, creating a prolongation of dwindled values for real estate. Most banks are sitting on vast numbers of collaterals with low values, hence exposed to valuation risk. Banks also face operational risk from several fronts: staff working from home cannot be controlled and supervised as good as when in the office; the change in working methods and processes has the potential of incurring losses or losing business, and the new systems in place due to covid19 may be compromised or not efficient enough for customers’ satisfaction. This scenario could result in reputation risk. In addition, the covid19 environment has exposed banks to market risk indirectly. Due to the growing uncertainty on the prospects of business rebound for industries like tourism, art and entertainment, travel, and hospitality, equity prices for companies in these industries are still vulnerable to volatility. If banks have extensive credit facilities made to such companies, they indirectly face market, equity, or volatility risks. In addition, due to a bad loan book, the bank's equity prices could dwindle as investors are likely to move their money elsewhere. All of the risks mentioned earlier could culminate into strategic risk for the bank if the bank manager does not make appropriate decisions, makes poor implementations of business decisions, or lacks responsiveness to changes in the banking landscape.

In conclusion, the social-economic environment of the pandemic poses the following inherent risks to banks: interest rate risk, credit risk, liquidity risk, operational risk, cybersecurity risk, data risk, customer data risk, market risk, equity risk, valuation risk, solvency risk, legal risk, strategic risk, governance risk, asset value risk, volatility risk.

Figure 6:

Representation of Online Shopping and E-commerce Images

Source: Google images

Pre- Covid19 Digital Transformation and Inherent Risks

Before the pandemic, the banking industry was already undertaking its digitalization transformation,largely compelled by consumers' demands, competition among the incumbents on digitalization, and competition from new entrants. The pre-covid19 journey has been a rough ride for the incumbents. They have faced seismic technological upheavals. Since the 2008 financial crisis, the incumbents have found themselves between two seismic forces: the aftermath of the financial crisis, during which time banks have continued to grapple with the burden of prudential regulatory requirements to remain liquid and well-capitalized; and the growing pressure of digital revolution due to competitive banking services from FinTechs and BigTechs (Wei, 2018). The introduction of Open Banking by the UK in 2018, and the issuing of the second payment services directive (PSD2) around the same time by the European Union, both of which were digital technology-based, allowed third parties, the non-bank organizations, to access customers' bank held data freely. Open Banking is a digital banking model that provides third-party financial services providers open access to consumersbanking and credit card transactions data, kept by banks and other non-financial institutions. Access is made possible through Application Programming Interface (API) (Fingleton, 2019). This banking model facilitates the networking of accounts and data across institutions to enable consumers, financial institutions, and third-party providers to transact safely.

Similarly, PSD2, as a regulatory directive, indicates that consumers have the right to use any third-party service provider to undertake online banking services. Among other things, PSD2 creates more competition in payments, controls the fraud risk, and accomplishes the Single European Payments Area (SEPA) in the EU (EU Journal, 2015). Both Open Banking and PSD2, besides creating more competition for the incumbents from non-bank entities, technologically, have exposed banks more to frauds, phishing, cross-border risks, and cybersecurity risks. The open banking model was created in the UK and adopted in almost all economic jurisdictions. In addition, customers bank data is prone to more exposure due to a wide range of touch points created by these two legislations.

The digital revolution in the banking industry was more of a banking services revolution than a technology revolution because it has revolutionized the delivery of existing banking services in the industry and paved the way for the introduction of new digital-based banking services, especially in the payments sector. Consumers prefer online and mobile banking services due to convenience and ease of access. This development has resulted in the gradual dwindling of physical bank branches.

The incumbents were fully aware of this challenge, and they had to accelerate their digital transformation to get closer to the level of FinTechs and Big-Techs. Nevertheless, such a strategy came at a cost on two fronts. Firstly, incumbents had to invest considerable sums in systems and training of staff. For example, Lloyds Banking Group allocated a £3 billion strategic investment for three years to enhance the development of digital banking products and to upskill its staff for the digital age; Deutsche Bank spends over $4 billion each year on digital technology, while JP Morgan spends around $7.4 billion (Wei, 2018). Secondly, such expenditure levels come when banks are experiencing a wave of low-interest rates globally. This scenario exposes the incumbents to many risks, such as failure to grow from their profits, compelling them to borrow expensive money from capital markets or fail to meet shareholders' expectations, which could result in disinvestment.

The presence of FinTechs and Big-Techs in the banking arena has, directly and indirectly, exposed the banking industry to a plethora of risks due to the changed market circumstances that have exposed the incumbents. The possible risks include: technology risk, cybersecurity risk, data privacy risk, digital conduct risk, reputational risk, infrastructure risk, compliance risk, systemic risk, model risk, market concentration risk, third party dependency risk, and strategic risk. The historical perception that the banking industry is private and protected industry is melting fast with digitalization.

Technology risk is the ghost in the machine (Mckinsey, 2016) whose impact seems to be endless as it creates other risks indirectly. Technology has become an integral part of banking. From the algorithms that drive ATMs and Point of Sales (PoS) machines to usage in proprietary trading strategies to the mobile applications, to customers use to deposit checks, pay bills and access credit, and so many other banking apps that continue to enter the banking processes and procedures (Mckinsey, 2016). Besides the significant improvements banks and customers have benefited from digital transformation, incumbents face many operational-related risks. These include disrupting critical processes outsourced to vendors, sensitive customer or employee data breaches, and coordinated denial-of-service attacks (Mckinsey, 2016). Another front exposing banks to technology risks is the increase in digital services apps supplied directly to customers. For example, with e-commerce increasing, hundreds of millions of mobile transactions are generated daily in the banking systems. These provide limitless entry points for fraud and cyberattacks.

Digital conduct risk is another pitfall for incumbents. The digital code of conduct involves values such as being respectful, appropriate conduct online, and good digital citizenship. Some examples of digital conduct risk include improper trading of an employee and third-party sharing of non-public information (Deloitte, 2020). Digital transformation exposes banks abundantly to digital conduct risk committed by staff. Therefore, it is imperative that staff training and reskilling in digital ethics occur correctly, as the consequences of not doing so can expose banks to litigation or legal risk. Huntswood (2018) observed that the Financial Conduct Authority (FCA) took a position on open banking, emerging crypto-currencies, and digital-based crowdfunding models. The action came after a long time of down-playing regulatory surveillance on these services including the digital-based challenger banks, indicating that the regulator was rethinking its agnostic stance and began to probe the risks banks and customers face in engaging in digital transformation activities.

Systemic risk involves the breakdown of the system in the industry ignited by one system component that links to a chain of other components. Banks are linked and dependent on one another in settling interbank transactions, short-term borrowing, financial intermediation, and maturity transformation in the banking industry. In the economic context, it involves the risk of cascading failure in the financial sector caused by linkages within the financial system, resulting in a severe economic downturn (CFA Institute n.d). The 2008 financial crisis that involved banks was, to a greater extent, due to systemic risk that occurred in mortgage lending, which went on unnoticed until the bubble busted. With financial stability concerns now emerging strongly in the banking industry due to digitalization, the incumbents would be the front-line victims of systemic risk because of their interconnectedness financially and digitally. The speed of technology advancement and the market concentration among technology providers pose systemic threats to the financial industry. Incumbents do not have the digital expertise to do all the necessary processes to deliver digital banking services. They outsource to FinTechs, which is one homogeneous group. This situation exposes banks to concentration risk and outsourcing risk. A failure in one component within the FinTechs can involve several banks. Digital technology advancement has accelerated how risks could spread across the entire banking system (Wei, 2018). Outsourcing of digital services also exposes banks to data privacy risks. The lack of transparency and auditability of Artificial Intelligence (AI) algorithms in trading poses macro-level risks in the banking industry.

FinTechs and Big-Techs are the main source of digital technology providers and drivers in the banking industry. This situation implies that digital banking solutions are in the hands of a few giant technology entities. Such a situation constitutes a hazardous market concentration for the banking industry. FinTechs and Big-Techs are the two big giants driving digitalization in the banking industry, that has disrupted the incumbents' traditional way of doing banking services, which exposes them to market risk induced by technological circumstances. These two digital giants have continued to introduce new services and business models in the banking industry.

On the other hand, the consumers have adopted and embraced the new services and models. This situation exposes the incumbents to model risk. Both the supply and demand sides of digital technology products have moved with a speed of adoption, creating digital disruption for the incumbents in the banking industry. This scenario leaves the incumbents with potentially obsolete legacy technologies, the mainframes, and overextended branch networks to compete against the new service standards provided by the FinTechs and BigTechs (OECD, 2020). Such a situation exposes the incumbents to strategy risk. Customers have new service expectations regarding the interface's convenience, user-friendliness, and transparency. In Asia and Africa, digital technological banking services have leapfrogged and reached the doorsteps of the unbanked population segments, which the incumbents have failed to provide. This development illustrates a cocktail of risks facing the incumbents, which include such risks like technology risk, reputational risk, infrastructure risk, model risk, market risk, and strategic risk.

In conclusion, prior to the civid19 pandemic, the prevailing circumstances exposed the banks to a broad spectrum of risks as highlighted above.

Covid19 Digital Transformation and Inherent Risks

Before the pandemic, the banking industry was already deeply engaged in digitalizing its processes and services to meet the overwhelming demands for digitalized banking services from its customers and fight competition. The incumbents' digitalization focused on front-end services through online banking, mobile banking, and internet banking. Customers access these services through cell phones, smartphones, desktops, laptops, and tablets. The pandemic has increased and expanded the use of these services, which has increased criminal cyber activities, including fraud and phishing attacks, as more employees work remotely. In the research by EY.com (2021), one participant said: "We have not yet seen the massive increase in sophisticated, advanced and persistent threats of cyber attacks that we normally associate with events like these.” (Ey.com, 2021). This evidence underscores the fact that the pandemic has exposed banks to more cyberattachks than before. The covid19 pandemic has made digital banking services awareness among individuals and across business sectors become a pressing and vital need, more so for the traditional banks, on the importance of digital connectivity, technologies, services and solutions (Cavallini et al., 2021). For traditional banks the pandemic was a wake-up call that digitalization of banking services is a success factor for every bank, big or small, new or old. As cited by Cavallini et al. (2021), in a 2020 global survey by McKinsey (2020) who found that the acceleration of digitalization in business caused by the Covid19 pandemic was significant and often quantifiable into 'years.' Covid19 affects the banking industry in two ways: by accelerating existing trends and creating new ones and has created a new normal, which means that it poses enormous additional challenges (Rolandberger, 2021). Businesses have been affected by an increase in customers' demands for online services, online sales, and purchases, the adoption of remote working, and the migration of business assets to the cloud. Business models also have changed accordingly to comply with consumers demands and the covid19 prevention protocols.

Social media has been one of the most preferred platforms for communication for both social and business needs. By demand drive, many customers access banking services through the social media. According to a study carried out by the American Bankers Association (ABA), almost half of bankers agree that customers will rely on social media as their primary method of communication with banks within the next five years (Stone, 2021). The social media platforms reach vast proportions of the population, allowing banks to effortlessly and cost-effectively reach large market sections. During the covid19 pandemic, social media platforms have provided quick and almost instantaneous communications in crisis management. Consequently, access to social media platforms increased due to the pandemic crisis.

Figure 7

Daily Average Time Spent on Social Media

Source: Statistica, 2022.

Note: Average daily times spent on social media networks in the US

Figure 7 above shows US citizens' pre-covid and in-covid daily average time spent on social media. From 2020, when the covid19 hit all corners of the world onwards, the average daily time spent on social media increased from 56 minutes to 65 minutes. This development is due to the need to communicate covid19 information among people and organizations, but most importantly, business and people conducted their shopping, payments, and business discussions on social media due to covid19 preventive measures. Banking services also accelerated through the media platforms.

Therefore, digital transformation in the current environment to achieve customer satisfaction depends on the quality of engagement rather than the differentiation of products and services. Such results will require building a digital infrastructure that can provide overtime insight with timeliness, personalization, and contextuality engagement, where trust and security are integral (Marous,2020).Nevertheless, using social media platforms to deliver banking services exposes banks to several risks, including security risks on customers data, the risk of cyberattacks on the banking systems, and compliance risks. 52%of Information Technology Enterprise and Security professionals stated that unsanctioned apps are their most significant security and compliance concerns ( SafeGuard Cyber Digital Risk Survey, 2021).

Under the Digital Transformation Front, traditional banks face a unique risk of evolving away from legacy applications and systems. Traditional banks system infrastructure and operational processes were built on the COBOL programming language, which was created over sixty years ago, and its systems cannot work together with the modern digital systems and infrastructures. The requirement to do away with legacy COBOL systems has been on the incumbents' agenda for over two decades without tangible action, rather than skating around it through peripheral digitalization of the front-end applications. The covid19 pandemic has made this need more pressing than ever before. The pandemic has drastically accelerated customers' demands for digital solutions. Customers expect a comprehensive service offering fast processes and an easy way to do their banking, any time, any place, with equally efficient Omni-channel services (Rolandberger, 2021). Apart from the colossal capital investment needed for this project, there are many inherent risks that has made banks' decision-makers always fall into procrastination to set the ball rolling. No banker has the technological expertise to handle issues for dismantling the legacy COBOL system into digital-based infrastructure. Hence there is great fear of technological risk and its consequences. There is fear of fraud, phishing, and cyber security risks that could penetrate the banking systems while the project is in progress, which could be hard to handle while everybody is still learning. These criminal activities have increased during the pandemic as people work from home. Cyberattacks such as the “distributed denial of service“(DDoS) attacks frequently increase every year. Such attacks can wreak havoc on a company's internet infrastructure, potentially sending domains and web-based services offline for hours and breaking functionality for their users (Buccella, 2021). Therefore, digitalizing the COBOL system would be more threatening considering that this project can only be done by outsourcing to FinTechs, the only known digital technology experts. This undertaking would expose the entire banking industry to concentration, outsourcing, and third-party dependency risks, besides cybersecurity concerns. In addition to these three risks, customers‘ data and the banks‘ data risks will arise because non-bankers are handling the project.

How can traditrionalbanks deal with such a scenario if it occurs? Proberbly, there is no definitive solution. But any failures that would ensue in such a project will erode the trust banks have traditionally had with their customers. This development would legitimize the FinTechs and BigTects challenger banks more as the only reliable banking institutions than is the case currently. Therefore, the banks' reputation will be at stake. The list of potential risks seems endless when one considers the digital transformation of COBOL systems.However,the overarching risk of all these potential risks is the risk of uncertainty that is hovering a dark cloud over the bankers on the legacy issues.

Traditional banks also face covert challenges emanating from the competition by the new entrants on the banking market, the FinTech challenger banks. Despite the remarkable achievements banks have made in the digitalization of banking services, the incumbents continue to face formidable competition from the FinTechs. By banking tradition, the banker-customer relationship exists on the inter-experiential information which ensues over time and from which the bank determines the nature of services suitable to the customer. FinTechs and BigTechs have hijacked this vital tool by using digital technology to process colossal amounts of data collected from a broad spectrum of business and social media touchpoints to determine customer service needs and desires. The new entrants have hugely been successful in rightly determining the customers‘ servicesexpections (OECD, 2020). Therefore, banking consumers increasingly expect their banks to be proactive in helping them manage their finances. In other words, banks must be customer-centric and not product-centric anymore, as has been the tradition in the banking industry. Banking services consumers expect a seamless experience across channels, with insights being the same regardless of the preferred channel (Marous (2020). The online and mobile banking services are the well-known cases in point which came at the right time for the covid19 pandemic, without which access to banking services in the pandemic environment is hard to imagine.

Nevertheless, the covid19 pandemic has made this competition worse and more challenging for the incumbents because social media and other digital financial services like e-commerce and other similar payment platforms have become routine. There are now more people shopping and making payments online. There is now a more significant population accessing social media; see Figures 8 and 9 below. The top three companies in Figure8, are Facebook, Youtube, and Whatsapp in 2020, which is at the beginning of the pandemic, have increased substantially in 2022, as depicted in Figure 8.

Figure 8

Figure 9

These platforms provide more touchpoints for relationship data which FinTechs and BigTechs exploit and erode more market opportunities from the incumbents. This covert scenario poses a substantial market risk for the incumbents in the prevailing circumstances and the future. In addition, fraud, phishing, cyber, and technology risks have become direct and more pronounced risks for the incumbents. When visualized, the whole scenario creates a strategy risk for the banks, which makes risk management in banks a hard nut to crack as the pandemic rages.

One of the significant challenges that top the banks‘ list of risks discussed in the boardrooms when it comes to digital transformation is the security of the IT systems and the bank’s data. There was a time when IT security was relatively easy. One would install a firewall, and that would be enough. (Stone, 2021). But the current level of technology has grown so big and complex with virtual connectivities. A typical banking environment has tens or even hundreds of thousands of networked computers and other connected devices in its portfolio. To this configuration, also, add the social media platforms, the cloud, and mobile channels. Such a scenario makes the potential attack surface continue to expand exponentially (Stone, 2021). In other words, the touchpoints that are open to fraud and cyber risks are limitless. The covid19 pandemic has worsened this vulnerability because banks have moved into this spot without commensurate preparations for mitigation and protection.

Nevertheless, the digitalization of banking systems has tailor-made solutions, the bespoke security and compliance solution, which can be created according to the system's demand to suit any size of the bank's portfolio of digital assets. This requirement, though, comes at an extra cost to the banks. Even with bespoke solutions, the risk of reliability without verifiable approved standards still exposes the bank to unknown risks, especially in the covid19 circumstances.

Historically and by tradition, banks' administrative and operational infrastructures are in silos. Each department has its system, procedural processes, and data collection and storage systems unique to itself. Inevitably, these architectural models have made traditional banks grow regressively, with limited scalability and inconsistencies in the delivery of customers services. These pitfalls became more pronounced with digitalization as banks faced competition from FinTechs. Traditional banks have built up an infamous reputation of giving their customers a vast runaround whenever they apply for a new service or ask for solutions (Stone, 2021). The pandemic has compelled banks to rethink their traditional siloed architectural business models. If adopted, the digital transformation would create a unified platform for banking systems, data processing, and storage for all departments to work in unison and benefit from eliminating bottlenecks of siloed environment. Currently, the information silos in the banks pose risks to security and compliance since there is a fundamental lack of cooperation and consistency in corporate policy-making (Stone, 2021). Moreover, in the covid19 pandemic environment, marketing has become key for the new front-line of brand defense, which cannot bring results without digital transformation. Here too, the incumbents face market risk.

In summary, covid19 has accelerated digital transformation risks traditional banks faced in the pre-covid19 pandemic time. With so many touch points in social media, the cloud, virtual connectivities coupled with the corresponding demands for digital services, banks face cybersecurity risk, fraud risk, phishing risk, money laundering risk, cross-border risk, reputation risk, business tech disruption risk, infrastructure risk, systemic risk, model risk, strategic risk, governance risk, compliance risk, outsourcing risk, market concentration risk, third party dependency risk in their daily operations.

Figure 10:

Photographs of the Emerging Market

Source: Generations y and z - social-media-3119jpg

Pre-Covid19 Demand Landscape and Inherent Risks

About three decades ago, any banking service was branch-based. The advent of digital technology fostered by FinTechs and Big-Techs has radically changed the banking services delivery system from predominantly branch-based to digital online platforms and big data (OECD, 2020). Digital banking services are delivered through desktops, laptops, tablets, and cellphones. The high-tech organizations outside the banking sector are setting the customer experience expectations of today's consumers. The reward for meeting these higher standards will be enhanced by the social media voice of every customer and member. Unfortunately, these same voices will be amplified when banks fall short of the expectations (Marous, 2020). In his speech at the 5th Afore Conference of the Supervisory Board of European Central Banks, PenttiHakkarainen said that “the speed at which FinTechs are rolling out innovative banking services has culminated into a severe disruption of traditional banking.Consequently, the legacy computer and physical infrastructures are becoming redundant as innovative digital service equivalents are replacing them, and there is no turning back”(Hakkarainen, 2021). FinTech’s banking products include payments and clearing systems, e-money, online lending, big data, blockchain, cloud computing, artificial intelligence, intelligent investment consultant, intelligent contract, just to name but a few. This development has enabled the under-banked and unbanked communities around the global to access banking services (Zuo, 2021).

Why do consumers prefer digital banking? Looking at Vietnam's population as a microcosm, in the study done by Annie Doung (2020), consumers are looking for speed, convenience, transactional efficiency, a choice of banking products delivery, access to competitive returns and prices, and an exciting experience when accessing financial services. Generation Y and Z are the upcoming generations and are gradually taking over the market. As the fabric of generations changes, more people who comprise younger generations are digital natives, and they turn to digitalized platforms to access their services’ needs.

Figure 11

Vietnamese Consumers Demographics

Source: LinkedIn.com 2020

In this study, 60% of the Vietnamese population were under age 35. This cohort comprises millennials and generation Z, both are digital natives. At 58% of digital natives, as indicated in Figure 11 above, this underscores the fact that the Vietnamese population is exponentially becoming a nation of digital natives. Banks in this country and other developing nations ought to take notice of the changing demand landscape and put in place the right plans and strategies for digital transformation.

Figure 12:

Vietnamese Online Activities Done on Smart Phones

Source: LinkedIn, 2020

Looking at the digital services accessed through smartphones, as shown in Figure 12, Vietnamese access most of their social services through digital platforms. However, banking services that are key to social-economic development have the lowest and almost insignificant access level, yet 58% of the population are digital natives in this country. This scenario indicates the banks’ failure to transform to digitalization in their services. Nevertheless, the demand landscape is changing fast for the banks, and they do not have the luxury of ignoring this development in the demand landscape.

The quest for digitalized services, which has grown so strong with generational changes in the markets, has initially turned what appeared to be an evolution of the banking systems into a long-term revolution of banking services. The Big-Techs, too, have joined the bandwagon and also provide financial services. In advanced economies, BigTech firms’ financial activities are generally more narrowly focused on payments and tend to complement the activities of existing financial institutions. In the emerging markets and developing economies, BigTech firms provide a broader range of financial services such as lending, insurance, and asset management (FSB, 2019)

The demographic changes on the demand side of banking services were the catalysts for digital banking. Generations X, Generation Y, and Z are digital natives, and they are the emerging population of the world. These generational cohorts have dominated the markets. They demand that financial services be accessed through a smartphone. The demand landscape for traditional banks has changed from predominantly physical branch-based to virtual platforms based through cellphones, tablets, laptops, and desktops, with branches becoming less preferred. This change came with many risks, such as cybersecurity risks and data privacy risks, which emerged due to exposure from many touchpoints involving online transactions. Third-party dependency risk emerged as banks outsourced digital services to FinTechs due lack of such expertise within banks. This approach also exposed incumbents to outsourcing risk as they did not completely control the outsourced jobs. As banks migrate more services to digital platforms, their physical infrastructure is becoming less required, thereby creating infrastructure maintenance costs that will drain resources without adequate returns. In terms of demand for services, banks are now limited by the demand of the dominating generations X, Y, and Z. This market condition exposes banks to market concentration risk. On top of this limiting factor, traditional banks, the world over, are limited by legacy infrastructures that are too rigid and administratively siloed for digital transformation (Doung, 2020)

In summary, the demand landscape faced by banks in the pre-covid19 pandemic was transitional as the generational fabric kept changing and continues to do so, from traditionalists and boomers to generations X, Y, and Z. This change has significantly also changed the demand landscape on the markets. The emerging generations demand digital-based services end-to-end.

Covid19 Demand Landscape and Inherent Risks

The digital technology age has increased customer expectations, known as 'the Amazon effect,' in which users expect instant access and immediate responses to their queries (Evans, 2021). The generational fabrics changes are driving this change in the markets from traditionalists and boomers to generations X, Y, and Z. The later generations are digital natives and demand digital-based services. They are the immediacy generations. For traditional banks, the impact of the Amazon effect is evident in banking consumers’ services demands for digitalized banking services, where immediacy is a vital feature. As banks struggled to meet these demands due to legacy systems and administrative and infrastructural limitations, the FinTechs and BigTectshave infested the banking market with their products overwhelmingly,and are embraced by the financial consumers. This development has created stiff competition for the incumbent banks. As the incumbents were reeling from this competition and the consequential disruption to their business, covid19 entered the stage. The coronavirus pandemic has changed people’s daily lives irreversibly. The recent research by Jan Bellens (2021), involving 250 banks in 50 different markets, states that the pandemic is reshaping the people's behavior in four ways: people are online banking, 66% of respondents said they bank online more and visit branches less; people use less cash, the decline in usage of cash has accelerated by 57% and credit card usage increased by 7% net, debit cards 10%, online payments 14% and contactless tools 34%; people look for responsible banks, 70% of respondents are looking for transparent and responsible banks; flexibility and security, 72% of respondents want flexibility and security banking (Bellens, 2021). In a short time, economies and societies at large were compelled by covid19 circumstances to adopt and adapt to the covid19 preventive measures, which were culturally and economically expensive. Industries such as air and water travel, hospitality, tourism, restaurants, and entertainment were hit the most and left reeling. Despite this harsh environment, some industries flourished. Those already in the telecommunication and digital technology business saw the demands of their service soaring (Rolandbarger, n.d.)

Did the coronavirus change the banks‘ demand landscape or accelerate the situation which existed in the pre-covid19? To a more considerable extent, the pandemic has changed the demand landscape in every industry. For the banking industry, direct and indirect changes have affected the industry’s demand landscape. Direct changes include: teleworking, where staff serves customers from the comfort of their homes through virtual platforms (Protiviti, 2021); low usage of cash, which has precipitated digital innovative payment methods like e-payment happening in e-commerce and shopping online; and the use of credit and debit cards has increased. The moratoria on loan interest accruals and repayments have negatively affected banks' liquidity. However, credit demand increased during the pandemic and has put banks under compliance risk with pressure on capital adequacy. Indirect consequences include the precipitation of non-bank digital payment services, which has eroded much of the traditional banks' payments business. Also, the pandemic accelerated the digitalization of banking services in both banks and non-bank companies to comply with covid19 preventive protocols, which became a legal requirement. Consequently, there is an increased fraud, phishing, and cyberattacks in banks. Teleworking affected the real estate business, where a drop in value for real estate collateral assets became ubiquitous, exposing banks to credit risk (Resti, 2021).

One of the consequences of the lockdown was the increase in remote shopping of goods and services. Shopping on the internet saw e-commerce sales increasing. Taking the European jurisdiction as a microcosm, Figure 13 below depicts the situation in 2020 when the pandemic hit all corners of the world.

Figure 13

Annual Growth of E-commerce Sales

Source:Oliver & Wyman, 2021

Figure 13 shows how countries in the European Union responded to lockdowns on the market. E-commerce sales immediately increased in this economic jurisdiction, ranging from a 13% increase in Germany to reach 24%, to 34% in Poland to reach a 50% level. Online shopping and payment methods helped countries limit the spread of the virus (Bounie et al., 2020). However, the increase in e-commerce sales for the banks meant a decrease in cash services. On the frontline, most bank branches became empty and irrelevant to the new order of banking services delivery, and many were earmarked for closing. For example, HSBC planned to scrap 35,000 jobs by 2022 to achieve $4.5 billion in cost savings. Deutsche Bank planned to scrap 18,000 jobs by the same deadline, and Unicredit also plans to scrap 13,200 jobs within 2023 (Tyce et al., 2020). In this scenario, banks face a broad spectrum of risks directly and indirectly, including model risk, operational risk, legal risk, reputational risk, market risk, cybersecurity risk, tech disruption risk, mental stress risk, infrastructure, and money laundering risks

The government moratoria on loans and public guarantee schemes are sustaining the banking system in the economic slowdown caused by the pandemic. The moratoria on loan interest accruals and repayments have negatively affected banks‘ liquidity. However, credit demands from MSMEs for operating capital have increased during the pandemic, putting banks under liquidity and compliance risk pressures (European Central Bank, 2021). Banks are getting liquidity support from central banks in each country. Nevertheless, as public support rolls back, a new wave of bad loans is expected to surface on the bank balance sheets (OECD, 2021). Figure 14 below depicts bankers' expectations of the covid19 pandemic‘s true impact on the industry when the supporting tools are finally removed.

Figure 14

Bankers Expecting Portfolio to Deteriorate in Respective Areas

Source: EBA Risk assessment survey in joint Committee of European Supervisory Authorities, 2021

Figure 14 above depicts the worst-case scenario when government support tools will finally end. 64% of the respondents expect credit risk from SMEs will top the list of exposurefor the banks. While 58% of respondents believe consumer credit will create more credit risk in the banks. 54% of respondents think that credit risk in commercial real estate will expose banks greatly. 48% of bankers interviewed believe credit risk in asset finance to shipping and aircraft will be a significant risk for the banks. These are the top four in the portfolio expected to face high credit risk. These are business sectors that had a high impact upon lockdowns. Besides the direct credit risk faced by banks in this scenario, there are also indirect risks on the banks' horizon, including liquidity, operational, legal, reputational, market, and strategic risks.

It is a well-known fact that the covid19 pandemic has accelerated the digitalization of banking services both in traditional banks and non-bank institutions. The Covid19 crisis has opened a can of worms in the experimentation and roll-out of new technologies across the EU financial sector (Campa, 2020). Financial service apps are ubiquitous both for banks and non-bank institutions. Everyone, irrespective of digital literacy, has developed confidence and trust in digital financial services' safety, efficiency, and reliability (Baicu et al., 2020). This development has encouraged the non-bank institutions to increase offering banking as a side product called "Banking as aService" (BaaS). Figure 15 below depicts the benefits of the BaaS Model, which bank executives believe accrual to traditional banks.

Figure 15

Potential benefits of the BaaS Model to Banks

Source:Capgemini Research Institute and EFMA, (2021), based on a survey of 122 bank executives. Share of respondents who assigned five or above (on a scale of 1 to 7).

While the incumbents perceive benefits from the accelerated digitalization of banking services and products due to covid19, they face a cornucopia of direct and indirect risks in this situation which include: operational risk, reputational risk, third party dependency risk, fraud risk, cybersecurity risk, conduct risk, and customer protection risk. In addition, the platforms of BaaS handle vast volumes of cross-border transactions which are not regulated to the same level as banks' cross-border transactions. This situation might cause instability and trigger some "step in risk" for banks who feel they would suffer reputational damage if the services provided through these digital platforms were disrupted. In conclusion, the risks the incumbents face from these benefits tend to be limitless.

Lastly, the covid19 pandemic has changed the demand landscape for banks. Consequently, banks face the following risks in their operations: model risk, cash risk, operational risk, liquidity risk, legal risk, reputational risk, market risk, cybersecurity risk, tech disruption risk, covid19 related risks, infrastructure risk,money laundering risks, cross-border risk, credit risk, and strategic risk.

Figure 16:

Representation of digital banking models

RESULTS AND ANALYSIS

Existence of Risks in Fronts

Historically, banking has evolved through banking services consumers‘ demands and the ensuing technologies of the time, both of which were the result of the prevailing conducive social-economic environment of the time. The literature review depicted in Table 1 shows an average increase in e-commerce sales due to covid19 covering seven jurisdictions globally from 16% to 19%. The level is a significant increase in a brief period, and it also represents an increase in the use of digital-based transactions that end up on the banks' databases where customers' information resides. The study further observes that pre-covid19 social-economic environment challenges still prevail in the covid19 environment, and with heightened impact. The pre-covid19 risks include low-interest rates, strict regulatory compliance requirements, and technology disruption, which have become more pressing. The moratoria on interest accruals and repayments also expose banks to direct credit andliquidity risks. Overall, from the Social-economic Front (SEF) perspective, it has been observed that the increase in online banking services, e-commerce services, and the accelerated pre-covid 19 challenges all expose banks directly and indirectly to the following risks: creditrisk, interest raterisk, equity risk, asset valuation risk, solvency risk, volatility risk, compliance risk, liquidityrisk, operationalrisk, marketrisk, legal risk, strategic risk, and governance risk.

Figures 7, 8, and 9 show that the increase in time spent on social media, together with similar significant increases in the usage of most famous media platforms like Facebook, Youtube, Whatsapp, Instagram, WeChat, and TikTok, were all due to covid19 in the digital transformation realm. These media platforms provide a wide range of touchpoints that can reach the banks through risky activities. In addition, the study notes that there was a significant increase in the usage of online banking services due to the pandemic control measures, which opened more avenues for risky events to reach banks. From the Digital Transformation Front (DTF) perspective, this development has created more loopholes where banks, directly and indirectly, face the following risks: cybersecurityrisk, fraudrisk, phishingrisk,technology disruption risk, governance risk, market risk, concentration risk, third party dependency risk, regulatory risk, data leakagerisk, privacyrisk, infrastructure risk, systemic risk, model risk, strategic risk, reputationalrisk,cross-borderrisk, and operationalrisk.