Accelerating Digitalization of Banks in Nigeria through Fintech Integration Strategies

The objectives of this article are to examine the role being played by Fintech adoption in the digitalization of traditional banks in Nigeria and to discover the most effective and sustainable Fintech integration strategy for bank digitalization in Nigeria. Through literature review, related theories were analyzed and conceptual framework established. Through a quantitative analysis of primary data, answers to the reaseach questions were provided. The outcomes of the research showed that Fintech adoption positively affects the acceleration of bank digitalization in Nigeria. Also, it was proved that among the five Fintech adoption strategies identified, digitalization of a bank’s internal processes most likely would lead a Nigerian traditional bank to an effective and sustainable digitalized bank.

-

Introduction

Banks and other financial institutions are known to be at the forefront of digitalization all over the world. There has always been the urge to satisfy and surpass the ever-changing expectations of the financial services consumers, a tendency that constantly place the banks on their toes to seek and deploy solutions that could keep their businesses relevant in the market. Therefore, digitization and digitalization are age-long practise in the business of banking globally.

Consequently, digitalization in Nigerian banks is not new either, as the banks have continued to lead the technology adoption with various innovations in their digital transformation journeys in the past couple of decades (Kola-Oyeneyin et al., 2020; Ojo & Nwaokike, 2018). In recent years, however, evolution of financial technology (aka Fintech) companies has become a disruptor of the banking industry, which among other impacts has been challenging bank digital transformation strategies.

How banks in Nigeria respond to the Fintech disruption has been a mix of strategic collaborations and venture capital investments all aiming at transforming a traditional bank into a ‘digital bank’; a technology-driven bank ready for the emerging financial market.

1.1 Digital Strategies

Businesses all over the world, including banking, are conscious of the rapid developments in digital technologies, and its persistent calls for strategic adjustments at various levels of operations and resources management. The tenacity and audacity of digital technologies cannot be ignored by any modern business player. Rather, discerning organizations are responding to the digital phenomenon with appropriate strategies.

The reality of new technologies and their diffusion into virtually all aspects of life provides wider options for businesses in developing digital strategies to enhance processes across the value chain. However, every organization requires a digital strategy appropriately tailored to its business for effective digitalization of internal processes and customer value proposition for success.

Studies have revealed that a group of new digital technologies with an acronym SMACIT (i.e. social, mobile, analytics, cloud, and internet-of-things) have the capacity for creating values for the modern business (Sebastian et al., 2017; Vial, 2019). According to these authors, these technologies pose a “game-changing opportunities and existential threats to big old companies” (Sebastian et al., 2017), while they are increasingly constituting disruptions to the customer behaviour and the competitive landscape (Vial, 2019). Digital strategies should be a part of a business strategy for an organization to have a good alignment. “A business strategy, inspired by the capabilities of powerful, readily accessible technologies (like SMACIT), intent on delivering unique, integrated business capabilities in ways that are responsive to constantly changing market conditions” (Sebastian et al., 2017). Consolidation of a comprehensive set of business strategies and a digital strategy produces what has been termed a digital business strategy (DBS), which an organization requires to drive result-oriented business agility and customer value propositions that suits the increasingly changing customer needs (Alt et al., 2018; Hornuf et al., 2020; Matt et al., 2015; Vial, 2019).

Arguing in favour of the relevance of DBS, Matt et al (2015) observed that DBS “is critical to obtain a close fit between digital transformation strategies, IT strategies, and all other organizational and functional strategies.” Also, it has been observed that a DBS could help an organization institute an enterprise-wide digital mind-set and instil the entrepreneurial spirit that characterizes startup companies (Alt et al., 2018). Studies have shown that leveraging new digital technologies has become a critical factor for competitiveness among modern businesses (Vial, 2019).

Moreover, the institution of the right leadership structure is required to drive an organization’s DBS (Hornuf et al., 2020). While Andersson & Tuddenham (2014) suggested that “carefully designed accountability structures and governance” under the oversight of a Chief Information Officer (CIO), Hornuf et al. (2020) opined that engagement of a Chief Digital Officer (CDO) with a similar portfolio would complement a digital strategy implementation.

As organizations’ digital transformation programmes are kicked off from different levels of development, firms with inadequate experience in DBS alignment could constitute a digital centre of excellence, comprising of representatives of the core business units, to create and drive the digital strategy to resolve competing priorities across business areas (Andersson & Tuddenham, 2014; Markovitch & Willmott, 2014).

1.2 Digital transformation

Change is synonymous to transformation, which its implementation is often supported by carefully defined plans. However, digital transformation (DT) involves changes that are implemented with a direct focus on new technologies. The implications of digital transformation go beyond organizational process redesign; they extend from the internal to the external ends of the business.

1.3 Digital Transformation Enablers

As earlier mentioned, the emergence of SMACIT technologies is a strong factor influencing DT in organizations globally. “Enabling the transformation are the devices for mobile connectivity, such as smartphones and tablets, and the creation of social networks, such as Facebook and Twitter.” (Berman, 2012) The internet and its derivatives have been identified as strong enablers of DT, accounting for a growing rate of penetration of two billion users, and wide acceptance of the social media as tools of communication and collaboration for 89 percent of the millennial and 72 percent of the baby boomers (Berman, 2012). Many organizations are employing an intelligent exploration of social media to gain insights into the needs and expectations of their customers (Westerman et al., 2014).

The resultant ‘big data’ characterized by high volume, variety, velocity, and veracity forms another critical enabler of DT. Because of its nature, the power of big data lies in the efficacy of the data mining and analytics tools used to turn the unstructured or semi-structured data into a powerful set of business information to drive product design and development appropriate to the customers’ needs and expectations (Berman, 2012; Vial, 2019; Westerman et al., 2014).

Furthermore, the ubiquitous nature of mobile devices is driving DT towards the creation of mobile solutions that perfectly fit into the emerging lifestyles of the new generation of users. Modern users are mobile and have turned their mobile phones, including smartphones into a platform not only for communication but also tools that connect them to the global markets for digital services (Björkegren & Grissen, 2018; Sebastian et al., 2017).

1.4 Benefits of Digital Transformation

Digital transformation could mean reinventing the IT function for some organizations. DT is helping organizations in the optimization of their resources for competitive advantage while they engage in the delivery of digital products and services to their customers (Andersson & Tuddenham, 2014). Digital transformation opens up new opportunities and enables organizations to achieve closer connections with their customers (Berman, 2012). For example, the music industry has witnessed series of digital transformations over the years leading to new market development for music firms that responded to the change positively, and spelling doom for those that refused to embrace the digital phenomenon.

Furthermore, literature has revealed that digitizing manual and paper-based processes makes it easier for organizations to collect digital data that can later be mined and analysed for better understanding of process performance, manage risks and cost drivers through a well-customized dashboard of data visualization (Markovitch & Willmott, 2014). Digitization can help reduce cost while making it easier to create products dynamically with better data-driven interaction with consumers for product customization (Björkegren & Grissen, 2018; Markovitch & Willmott, 2014). Modern organizations should not fail to appreciate the benefits of digital transformation, which is the bedrock of driving the transition of the value chain from traditional to digital across all industries, including banking where financial technology (a.k.a. Fintech) companies are leading in the deployment of new technologies.

2. Literature review

2.1 Fintech Evolution and Potential

The term financial technology (Fintech) is used as an identifier for an organisation driving the provisioning of the financial services aggressively with the use of technologies. Because of their focus on development and delivery of financial products and services, with deliberate intent to adopt diverse technologies and be more customer-centric, offer convenience with relatively lower transaction charges compared to those obtainable among the traditional banks, the Fintech has become a noticeable disruptor of the financial industry globally.

In the same context, Ojo & Nwaokike (2018) defined Fintech as “the process or hybridisation of technology with the traditional method of finance” to drive development and delivery of specific financial services like payment processing, deposit accounts, credit, life insurance, etc. in a way that replaces the traditional structure and way of working using processes driven by new technologies. In defining Fintech, Alt et al. (2018) considered two perspectives – functional and institutional. According to these authors, the functional perspective of Fintech defines it as an entity that comprises a wide range of “innovative ideas and new business models enabled by digital technologies.” This perspective covers Fintech solutions designed for customers’ use for personal finance, payment (e.g. blockchain), funding and lending, insurance, etc. (Alt et al., 2018). On the other hand, when viewed from the institutional perspective Fintech is considered as a specific type of startup business (Alt et al., 2018). The institutional perspective is corroborated by a McKinsey & Company’s report, which defines Fintech as “technological innovation in the prevailing model of delivering financial services, covering different types of players (incumbents, startups, technology companies, etc.) and an array of business models (B2B, B2C, etc.).” (Kola-Oyeneyin et al., 2020) This perception places Fintech beyond being a provider of technology or infrastructure to financial institutions only but does include the incumbents with fintech offerings (Kola-Oyeneyin et al., 2020).

Fintech drives financial innovation technologically leading to new products and business models, digital applications, as well as processes with overall tendency to cause changes in the traditional markets and institutions of financial services (Hornuf et al., 2020; Kyari, 2020). In consideration of the Fintech technology capabilities, many banks are leveraging Fintech startups through collaborations to achieve their digitalization goals (Hornuf et al., 2020).

2.2 Fintech Development in Nigeria

Literature has attributed Fintech evolution to the aftermath of the 2008 global financial crisis, which resulted in the emergence of more stringent regulations for the banking industry leading to and exposing a vacuum of innovation in traditional banks and disruptions in the investment trends within the industry (Ojo & Nwaokike, 2018). In Nigeria, the Fintech emerged to address some unmet expectations of the financial services consumers, most of which had lost confidence in the traditional financial institutions as a result of their inability to provide the required convenience and accessibility to financial services (Kola-Oyeneyin et al., 2020; Ojo & Nwaokike, 2018).

According to a report, the fundamental factors aiding the growth of Fintech in Nigeria are access and convenience, while trust is equally important (Kola-Oyeneyin et al., 2020). Findings have shown that financial consumers increased their fintech penetration by 54 percent over the past six months while 57 percent of the customers stated access and convenience as reasons for choosing fintech (Kola-Oyeneyin et al., 2020).

Other factors are contributing significantly to the development of the fintech industry in Nigeria. Positive developments in the telecommunication sector coupled with the growth in the diffusion of mobile technologies, including the proliferation of mobile devices together with smartphones are justifiable complementary factors aiding fintech activities (Kola-Oyeneyin et al., 2020; Ojo & Nwaokike, 2018). Moreover, some regulatory policies towards a cashless economy and financial inclusion are factors creating the right environment for the fintech industry. For instance, the Central Bank of Nigeria (CBN) launched the Cashless Policy in 2012 as part of the Payment System Vision 2020. Similarly, the introduction of the Bank Verification Number (BVN) has enhanced the practice of the know-your-customer (KYC) policy and enabled effective creditworthiness assessment that many fintech applications use today (Anichebe, 2019; Kola-Oyeneyin et al., 2020; Ojo & Nwaokike, 2018).

The population distribution of Nigeria has revealed that about 115 million people, of a total population of 200 million, are belonging to the young millennials with age below 35 years (Anichebe, 2019). The financial inclusion potential is high with approximately 60 million Nigerians that are without a bank account (Kola-Oyeneyin et al., 2020). These are all indicators of great opportunities for Fintech growth in Nigeria.

2.3 Fintech Investments in Nigeria

Fintech industry in Nigeria has received significant participation of local and foreign investors, with over $200 million recorded as a foreign direct investment (FDI) within 2016 and 2018, placing Nigeria in the rank of the top three nations in Africa in that period together with Egypt and South Africa (Ojo & Nwaokike, 2018). Furthermore, a report as shown that, Nigeria has recorded more than 200 standalone fintech entities, together with several fintech solutions offered by banks and telecommunication companies (telcos) to complement their product portfolios (Kola-Oyeneyin et al., 2020). The report further revealed that funding of $600 million was attracted by Nigeria’s fintechs between 2014 and 2019, where 25 percent of the $491.6 million generated by African tech startups in 2019 was injected, placing Nigeria second to Kenya in fintech’s investment growth (Kola-Oyeneyin et al., 2020).

Given all the supporting factors including the surge in e-Commerce and smartphone penetration (Ojo & Nwaokike, 2018), the combined supportive infrastructure and regulatory environment, access to funding and the right talent pool, the fintech sector can attain the value at stake (Kola-Oyeneyin et al., 2020). As reported by Ojo & Nwaokike (2018), Fintech operations recorded an average of $5million as monthly transaction value in 2011, which increased to $142.8 million in 2016.

However, Fintech still has a lot of potential and quite huge opportunities yet to be taken up in the Nigeria financial ecosystem. Kola-Oyeneyin et al. (2020) observed that, despite the success accorded to the fintech industry in Nigeria, the fintech sector is still relatively young as 40% of the population of 200 million is still financially excluded. Fintech is expected to open financial access to the vast population of the unbanked and underbanked that have suffered neglect from the traditional incumbents owing to perceived high onboarding costs and their preference to corporate and medium-to-high net worth customers for better turnover (Steeves, 2016). This is not unconnected to the significant investments required by Fintech to develop commercially viable solutions to address the mass-market segment (Kola-Oyeneyin et al., 2020).

Challenges confronting Fintech development in Nigeria are not far-fetched as they are challenges associated with new technologies naturally, coupled with environmental and infrastructural challenges. The fintech sector still suffers “regulatory uncertainties affecting investors' participation, hostility from Financial Services (FS) incumbents, poor data protection, terrorism financing, money laundering, cybercrimes, identity theft or fraud, business and financial crimes.” (Ojo & Nwaokike, 2018). Despite these challenges, Fintech startups can still leverage on the opening being created by the current banking environment featuring poor or lack of access to financial services (especially in the rural areas), service affordability, poor and frustrating user experience, all contributing to the pain points the Fintech operators can target for building customer value propositions (Kola-Oyeneyin et al., 2020).

2.4 Impacts of Fintech Evolution on Banking in Nigeria

The reality that Fintech and the banks are targeting the same market puts both sectors at loggerhead of a kind globally. The Fintech reality is the root of competition brewing in the banking industry, as Fintech startups and other non-bank industry players are entering the financial market with new products with added convenience, safety, and ease of use built around the same products previously known to be in the offerings of only banks (Kyari, 2020; Steeves, 2016). The immediate impact of Fintech evolution emanated from the introduction of technology disruptions into the financial industry through the competing innovative financial products and services being offered by the fintech startups (Kyari, 2020), causing the players in the banking sector to re-assess their business strategies and models.

Fintech has been adjudged a significant disruptor of the banking industry (Alt et al., 2018; Kyari, 2020; Steeves, 2016). Fintech is rapidly changing the landscape of banking with more customer-centric financial solutions and products at lower costs (Alt et al., 2018; Ojo & Nwaokike, 2018). For instance, in the area of payments, customers are now open to diverse options that guarantee convenience and low service rates. Entities like Paga, OPay, Cellulant, and Interswitch’s QuickTeller are competing to enable payments for bills, airtime recharge, fund transfers, online purchases and other payments activities that customers can now enjoy across various platforms like mobile banking apps, and the use of the unstructured supplementary service data (USSD), by which any mobile phone could be used to execute payment transactions (Kola-Oyeneyin et al., 2020).

One apparent feature of the Fintech’s impacts on the financial market is the reawakening to digital transformation among the Nigerian banks. The new dispensation is witnessing the emergence of digital solutions being offered by the banks more than ever. Aside from the back-office where process transformation projects of various kinds are taking place to reshape the banking business models in conformity to the market demand, the front-end of banking is rigorously transforming to offer a cross-platform excellent customer experience (Alt et al., 2018). Bank customers with smartphones and mobile devices now carry their bank mobile apps each opening access to various financial services. For instance, Stanbic IBTC’s mobile App offers customer access to banking, insurance, wealth management, pension, stocks, and credit facility on a B2C model. However, studies have shown that of these various service segments, payment is the most prevalent where Fintechs are striving (Hornuf et al., 2020), yet, “Payment solutions currently represent around 15 percent of banking revenue pools in the country and continue to grow.” (Kola-Oyeneyin et al., 2020)Nevertheless, Nigerian banks are getting more digital than ever as a result of the Fintech revolution and integration of fintech into banking. Fintech offerings are gradually expanding from payment to credit, assets management, and other sectors.

Some Fintech startups are adopting different specific models to carve out a niche for themselves in the ecosystem. While some startups are focused on specific products niches like payments and credit, others are targeting to serve the SMEs segment or some specific geographies. Some Fintechs have adopted the B2B model to offer support to the incumbents and corporate organizations to achieve their digital business strategies. This segmentation of roles has enabled the players to excel in their spaces and making them attracted to larger players for acquisition (Kola-Oyeneyin et al., 2020).

It has also been argued that Fintech is complementing the bank by aligning multiple online channels and partly substituting the branch offices whereby “core competencies shifted from customer service, products and transaction handling towards the management of online channels, data analytics and platforms.” (Alt et al., 2018). The market trends in the financial industry are mounting pressures on banks to prioritize digital transformation as a core part of their business strategy through digitization of every data element and digitalization of every business process.

2.5 Fintech and Digitalization of Banks in Nigeria

While Nigerian banks are open to many strategic options to achieve their digitalization goals, the time-to-market is a crucial factor guiding the direction of a decision in that aspect. Digital transformation is usually a long strategic journey that could last over a year depending on the complexity and availability of resources. However, the market seems not ready to entertain the kind of patience required for a long digital transition. This is more so in the market where customer behaviours are highly defined by liquid expectations. The concept of ‘liquid expectations’ (or ‘fluid expectations’) describes “a perceptual gap that consumers feel when they encounter inconsistencies between a good experience they have had in the past and the current experience they are having.” (Mathew, 2018). Customers are porting experiences among different organizations or service providers regardless of the size and nature of business. For example, a customer may want to have the same treatment he/she received at the reception lobby of a 5-star hotel in the waiting lobby of a bank. The interesting part of liquid expectations, therefore, is where customers are porting experiences across all industries – comparing their experiences at a company in one industry with another company in a different industry. Financial services consumers feel that they should get the same top-notch treatments they receive from the Fintech startups from the traditional banks, especially when it comes to technology-driven services, as customers expect banks to develop their digital services (Hornuf et al., 2020). Therefore, traditional banks need to digitalize and rapidly, too to avert a degraded competitive advantage. The customers’ preference for digital services than the traditional ones is a global reality. For instance, Björkegren & Grissen (2018) reported that in Kenya more individuals preferred to take loans via digital platforms than traditional banking.

To guarantee the quicker result and shorter time-to-market in digitalization, banks are devising different strategic methods.

2.6 Bank Digitalization

The ultimate goal of digitalization programmes in a traditional bank is to transform the bank to a digitalized bank (or ‘digital bank’). Digital banks are characterized by product portfolios containing significant numbers of digital products and service channels (Hornuf et al., 2020; Kyari, 2020; Vial, 2019). A bank could approach this objective in various ways as accommodated by its digital business strategy (DBS). Also, digitalization in banks can differ in scope and complexity, however, a digitalized bank is expected to have digitally transformed most of the processes driving its activities from the back-end to the front-end. A bank needs to adopt a Digital Transformation Framework (DTF) that guarantees a comprehensive transformation of its value creation paths, putting into consideration the harmonization of four dimensions – changes in value creation, use of technologies, structural adjustments and financial aspect of the business (Matt et al., 2015; Vial, 2019).

The current outbreak of Covid-19 pandemic has not only heightened the importance of digitalization in banks, it has also exposed the weak points of those banks that were beforehand believed to have advanced in digitalized processes. The general experience did show that many banks in Nigeria failed badly to satisfy the needs of their customers via their online and mobile platforms during the lockdown. Also, they were struggling to accommodate the sudden influx of customers into their banking halls after the lockdown as a result of their failed digital channels. Digital transformation in banks should pass the test of times by proactively addressing unpredictable situations like the pandemics.

To achieve a robust digital transformation, Westerman et al. (2014) suggested that a business needs to consider three core areas – customer experience, operational processes and business models. For better clarity, these authors outlined three other elements comprised in each of the core DT areas. Firstly, customer experience transformation should comprise customer understanding (i.e. use of social media exploration, brand promotion via digital media, etc.); top-line growth (i.e. transforming sales by replacing paper-based pitches with digital presentations via mobile devices); and customer touchpoints (i.e. using digital initiatives to transform customer engagement through multichannel services, e.g. use of USSD and online chart) (Westerman et al., 2014). Secondly, transforming operational processes should involve process digitization (i.e. process automation; worker enablement (i.e. workplace flexibility for workforce mobility, collaboration and teamwork); and performance management (i.e. supporting quality decision making with the use of transactional systems with real-time data not based on assumption) (Westerman et al., 2014). Lastly, transforming business models comprises digitally modified business (i.e. digitalization of the way business is done, e.g. e-commerce); new digital businesses (i.e. introducing digital products to complement traditional products); and digital globalization, which ensures that an organization benefits from the global synergy through transforming from multinational to truly global operations (Westerman et al., 2014).

A traditional bank can borrow from the DT model illustrated by Westerman et al. (2014) by ensuring a comprehensive transformation of its internal processes, customer experience and business model to align with the dynamic market (Hornuf et al., 2020; Kyari, 2020; Vial, 2019; Westerman et al., 2014).

2.7 Bank Digitalization and Fintech Integration Strategies

The time-to-market is of the essence in digitalization projects in Nigerian banks. The traditional banks have woken up to discover their digital lags after the Fintech evolution reality in the Nigerian financial industry. Most of the banks realized the opportunity in leveraging the Fintech as a quick fix for their digital lags (Anichebe, 2019), while some choose to engage in phased digitalization of processes, each aiming to transform to a digital bank, prepared to compete in the new market.

Fintech companies in Nigeria are still largely dependent on the banks in connecting to the market where the incumbents have a strong dominance. Apart from SunTrust Bank Limited, who after obtaining the CBN’s license for operation, launched in 2016 as a full-fledged Fintech bank in Nigeria, other Fintech entities are reliant on the banks for one thing or the other (Anichebe, 2019; Kola-Oyeneyin et al., 2020). For instance, Fintechs rely on banks especially for connecting to the banks’ existing customers and infrastructure via the use of application programming interface (API) for data interchange. However, the launch of SunTrust Bank Limited encouraged new entrants like Flutterwave, Nairabox, Paystack, GoFundMe, Paga, Piggybank, Remita, etc. A report has shown that a number of the Fintech startups like Paga, OPay and Interswitch (Quickteller) compete with mobile banking applications and USSD with their ranges of digital solutions for fund transfers and bill payments (Kola-Oyeneyin et al., 2020). This development has shown that despite the reliance of Fintech on banks, there still exist some grounds for competition between banks and Fintechs.

However, studies have shown that banks are benefiting from forming alliances with Fintechs to drive their digital business strategies. According to Hornuf et al (2020), “the bank value increases by 2.5 to 3.2% after the digital bank announces a new alliance with a Fintech.” Moreover, banks have chosen to invest significantly in digital banking by migrating from being traditional to technology-based using options ranging from raising Fintech companies through a startup programme; funding Fintech companies through venture capital; partnership with Fintech companies; or launching Fintech companies of their own (Kyari, 2020).

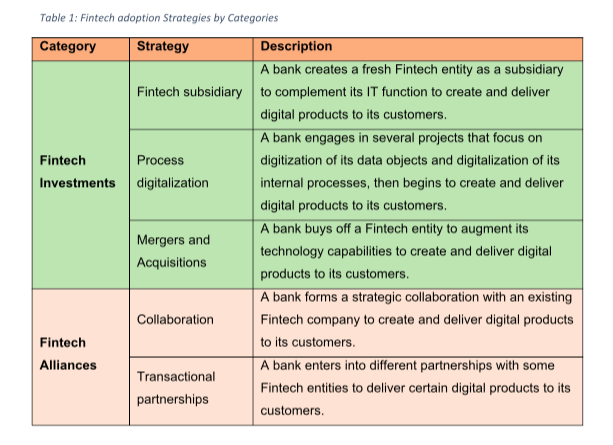

It has been sufficiently argued that banks are adopting fintech integration through two broad methods – Fintech investment and Fintech alliance (Hornuf et al., 2020; Kyari, 2020). In other words, a bank could either venture into some kind of investments aimed at developing a custom financial technology capability or engage in some strategic alliances with existing Fintech companies to achieve its financial technology transformation objectives. In this article, five approaches have been identified by which a Nigerian traditional bank could achieve its digitalization through Fintech integration. As shown in Table 1, the five strategic methods are categorized into two in line with the theory facilitated by Hornuf et al. (2020) and Kyari (2020).

2.7.1 Fintech Investments

A bank could venture into developing a home-grown Fintech entity to realize its digitalization agenda as earlier mentioned. This could be achieved in one of three ways – by creating a Fintech subsidiary, process digitalization or mergers/acquisitions. In any case, the ultimate goal is to transform a traditional bank into a digital bank.

In Fintech subsidiary a bank decides to create a financial technology subsidiary to complement its existing information and communication technology (ICT) directorate and fully dedicated to development and delivery of digital products/services to its customers. This approach could lead to realizing a home-grown Fintech function that the bank could rely on for consistent roll-out of new digital products and customer experience enhancements. However, this approach could be time-consuming and capital intensive with structural changes to be managed before the new digital products can get to the market. Also, recruits could be required as the existing human capacity may lack the requisite skills to float such a specialized function of the bank.

Similarly, a bank could achieve a home-grown Fintech entity through a well-designed process digitalizationprogram. In this case, rather than seeking for a party to complement the existing ICT department, the ICT teams are directly involved in a set of projects that aim at digitizing the bank’s data objects and digitalizing the bank’s internal processes from the back-end to the front-end. While external consultants and service providers could be engaged in this process to supply the necessary skills and services, the in-house ICT teams, under the oversight of the Chief Information Officer (CIO) or Chief Technology Officer (CTO), are the project owners with the responsibility to project-manage the entire process and retain ownership afterwards.

Although this approach could amount to a huge investment in time and capital, the mere fact that the program was internally conceived and developed could enhance its bespoke nature. Also, the approach can lead to better effectiveness as the resulted Fintech function would be seating at the centre of the organization with better access to resources and central management attention (unlike a subsidiary).

The third strategy, mergers or acquisitions is when a bank decides to acquire or merge with an existing Fintech entity to accelerate its digitalization process. The acquired Fintech company is absorbed by the acquiring bank and it automatically becomes part of the existing technology structure of the bank saddled with the responsibility of developing and delivering digital products and services to the bank’s customers

While this approach seems to be the fastest way of transforming a traditional bank into a digital bank through investment, the requisite feasibility studies and due diligence activities could be time-consuming. Also, legal issues always present themselves to be resolved as well as structural changes to be managed. Extensive stakeholders’ management is usually required to support mergers and acquisitions.

2.7.2 Fintech Alliances

Strategic alliances appear to be the most popular approach to bank digitalization for financial technology and digital product development and delivery across the globe. This is not unconnected to the fact that, according to Hornuf et al. (2020), banks stand to benefit from the innovations offered by the Fintechs through strategic alliances in a way that goes beyond the ‘make-or-buy’ approach. Besides, strategic alliances seem to support a shorter ‘time-to-market’ for banks undergoing digital transformation to deliver digital products/services. Fintech alliances could take place in two ways – collaboration and transactional partnership.

Collaborations between banks and Fintech startups are a common phenomenon that emanated from the disruption reality that fintech evolution/revolution introduced to the financial services industry. Banks have realized that rather than engaging in unhealthy competition with the Fintechs, which have already penetrated the market and succeeded in capturing the loyalty of the consumers by redefining their taste and expectations, collaborating with them would be a wise option. Many Nigerian traditional banks are forging their ways into digitalization with Fintech integration and alliances through collaboration (Hornuf et al., 2020; Kola-Oyeneyin et al., 2020; Kyari, 2020).

In collaboration, a bank and a Fintech entity agree to work together to create and deliver certain digital products to the bank’s customers. While the two organizations are still maintaining their different corporate identities and structures, a memorandum of understanding (MOU) forms the legal working paper that spells out the scope of work and the responsibilities of both parties in the collaborative alliance. The alliance is usually for a specific period that could be terminated or renewed subsequently. The idea of collaboration looks sensible, especially to banks that lack the internal capability to develop their digital services due to their legacy IT or organizational structure (Hornuf et al., 2020).

A bank can operate alliances in form of transactional partnerships, where a bank engages in partnerships with one or several Fintech entities to develop and deliver different kinds of digital products and services to the bank’s customers. Although similar to a collaboration strategy in its formation, a transactional partnership could be devoted to the development of a single digital product/service, e.g. payment or credit. A bank that offers a list of several digital products with digital platforms like online, mobile, and USSD codes to facilitate customers’ banking transactions could have achieved that through partnerships with different Fintech startups.

This approach also offers a fast digitalization but, as in collaboration legal issues and conduct of due diligence are necessary pain points, which could develop into a complex and nasty situation for a bank that needs to contend with several cases under the diverse partnerships.

The research in this article aims at identifying the most effective and sustainable among the different strategic approaches described above for an accelerated digitalization in most Nigerian banks.

3. Methodology

The research methodology adopted in this article is based on a quantitative analysis of primary data. Hence, an online survey was conducted to gather data from a population size of 140 participants out of which 86 responses were received. The survey had a 98% completion rate.

The questionnaire was designed based on achieving the purpose set for this article. In effect, the Likert scale style of rating formed part of the questionnaire design where relevant. Using a five-scale Likert in each case enabled the provision of independence to respondents with a balanced level of choice and neutrality representing a symmetric way of rating (Joshi et al., 2015). Analysis of the data gathered was based on measurement of central tendency for an interval scale which can be derived by combining the items to compute the composite score for a set of items rated by different respondents (Joshi et al., 2015). Where applicable, statistic elements like weighted average and standard deviation values were computed to draw insights from the data relationships.

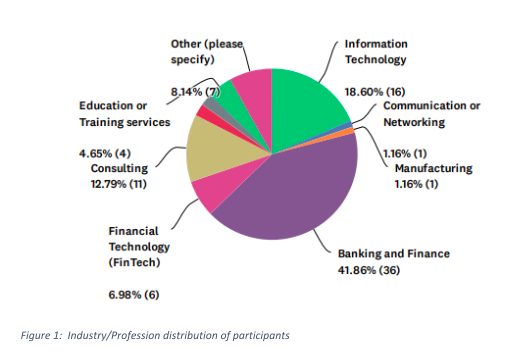

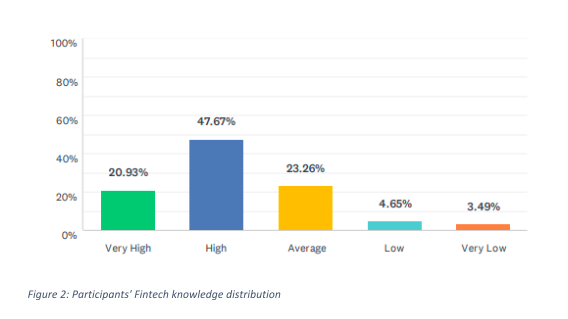

To ensure appropriateness and data quality, the survey was targeted mainly at individuals who were players in the financial/banking industry – either by profession or career. This is intended to ensure that majority of the participants did respond based on a good level of Fintech and banking knowledge.

4. Discussion of findings

Captured as part of the respondents’ profile information was the profession or industry each respondent belonged to. This was intended to measure the level of participation of members of those industries or professions considered to be core and most closely related to the research’s subject. These were the banking/finance, Fintech and information technology (IT) industries. Figure 1 shows the distribution of survey participants across the industries/professions.

The combined percentages of participants from the three core sectors accounted for 67.3% indicating a good participation level of players within the industries relevant to the subject of this research. This outcome enhanced the credibility of the data collected from the survey as representing the right target audience capable of influencing correct overall perceptions captured in the respondents’ answers to the survey questions.

Furthermore, the participants’ level of Fintech knowledge was tested using a 5-point Likert scale. Figure 2 indicates that 47.67% rated their Fintech knowledge as high while that of 20.93% of the respondents were rated very high. This gave a combination of 68.6 percent of all the respondents that were knowledgeable in Fintech while 23.26% were averagely knowledgeable. This distribution further strengthens the quality of the data collected; largely received from the knowledgeable audience.

4.1 Accelerating Digitalization of Nigerian Banks with Fintech Adoption

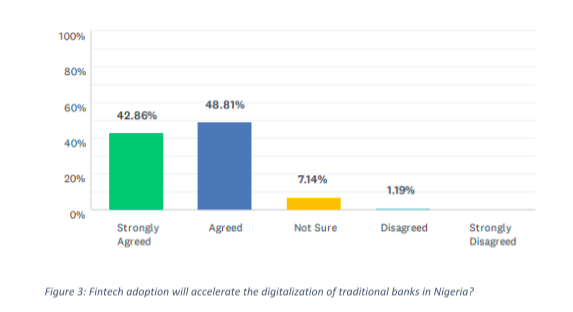

One of the research questions for which the survey was designed to answer was whether or not Fintech adoption was aiding acceleration of bank digitalization in Nigeria. The survey question in this respect requested the participants to rate their level of agreement with the notion that says "Fintech adoption will essentially accelerate the digitalization of traditional banks in Nigeria." Using a 5-point Likert scale, the respondents overwhelmingly agreed to this notion with a combined percentage score of 91.7% of the participants.

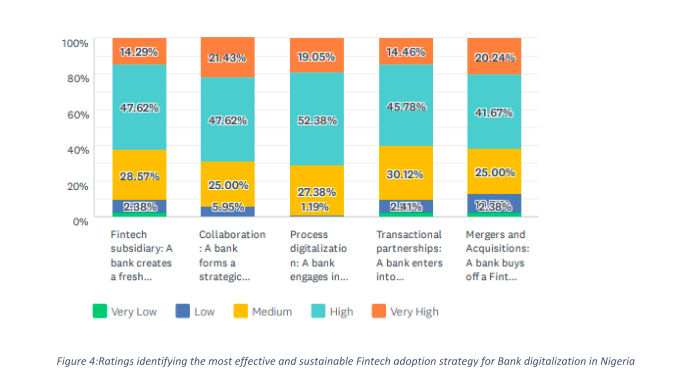

This led to the question intended to evaluate the perception of the respondents in identifying the Fintech integration strategy that offers the most effective and sustainable approach to traditional banks in Nigerian in accelerating their transformation to digital banks. The questionnaire was designed in a matrix of 5-point Likert scales to cover the five strategies discussed in Section 2.7. The participants were requested to rate the Fintech adoption strategies in terms of how effective and sustainable each is capable of rapidly transforming a traditional bank into a digitalized bank in Nigeria.

The visualization in Figure 3 indicates that all the strategic options were highly rated as the larger share of each block was apportioned to ‘high’ and ‘very high’ ratings as the case may be. Furthermore, Table 2 shows that each of the strategies recorded a weighted average (mean) well above 3 (‘Medium’) and a standard deviation of less than 1. This high-level result has helped to validate, on one hand, the fact that any of the listed strategies could lead to a successful transformation of a traditional bank into a digital bank in Nigeria.

On the other hand, a closer view of the statistics revealed that ‘process digitalization’ had the highest weighted average (3.89) and the lowest standard deviation (0.71). This was closely followed by ‘collaboration’ with a mean of 3.85 and a standard deviation of 0.82. This result has shown that, regardless of the generally perceived long duration required to achieve bank digitalization towards attaining financial technology (Fintech) capability through process digitalization projects, majority of the respondents believed that it is the most effective and sustainable approach to adopt. This result has negated the more talked-about strategic collaboration between banks and Fintech startups as the leading bank digitalization approach. However, the result has corroborated the finding of Hornuf et al. (2020), which suggested that in the short term, investors perceived bank's alliances with Fintechs as having negative effects on a bank's value. In effect, the markets expect that a bank should be able to develop its technology capability to deliver digital products or services (Hornuf et al., 2020).

4.2 Fintech Investments and Fintech Alliances

The statistics presented in Table 2 above can further be related to the two Fintech adoption strategy categories discussed in Section 2.7 – Fintech investments and Fintech alliances. As earlier discussed, a bank could choose to walk its way into digitalization to deliver digital financial services through capital investment in developing its home-grown Fintech function or form a kind of alliance with an existing Fintech company. The result of the analysis as presented above has enabled us to identify which strategic approach is most preferred by the respondents within each of these two categories. Precisely, ‘process digitalization’ had the highest preference than the other two Fintech investments options while ‘collaboration’ led in the Fintech alliances category.

5. Conclusion

The global banking industry has welcomed the Fintech phenomenon over the last decade where every player concerned have had to adjust and re-strategize to remain competitive in the dynamic markets. Fintech has consistently acted as a disruptor of the Nigerian financial services industry with the tenacity to alter the financial landscape and redefine the consumers’ requirements to a level compared to liquid expectations. Fintechs, using their nimbleness and agility, are offering digital products and services at much cheaper and faster delivery rates coupled with the convenience that readily go deep into the hearts of financial services consumers thereby enhancing loyalty in favour of Fintech operators. Fintech has also boosted the Nigerian economy through foreign direct investments as many investors from oversea are coming into the country to establish their fintech businesses and challenging the status quo.

Nigerian banks are not unaware of the development and, rather than concentrating on engaging the Fintech startups in unhealthy competition, banks are focusing on their digital business strategies to transform from traditional to becoming digital banks. Conscious of the fact that digital transformation requires an appropriate approach to succeed, traditional banks are choosing between fintech investments, where a bank puts down the resources to develop a home-grown, bespoke fintech business unit, or engage in a strategic alliance with an existing Fintech entity. In this article, three options were presented under the Fintech investments category, these are Fintech subsidiary, process digitalization and mergers/acquisitions. On the other hand, the two options presented under Fintech alliances are collaboration and transactional partnerships, or what Hornuf et al. (2020) referred to as product-related collaborations.

Time-to-market is of the essence, hence banks need to consider an option that could accelerate the transformation process such that digital products roll-out can meet the aspired specifications and waiting time of the consumers. This article has used a quantitative research approach to answer the question of whether or not Fintech adoption could help accelerate bank digitalization in Nigeria. The outcome was in affirmative, proving that digitalization of traditional banks in Nigeria can be aided by Fintech adoption. Furthermore, the outcome of the research has proven that the digitalization of a Nigerian bank through well-executed digitalization programs of its internal processes would produce the best result in terms of effectiveness and sustainability. It can be deduced that regardless of the enormous time and capital budget required to achieve a ‘digital bank’ through a comprehensive process digitalization program, it has the highest preference of stakeholders when the benefits of ownership, customisation and sustainability are considered. Otherwise, bank-fintech collaborations could be explored by a bank with weaker capital and higher priority for faster time-to-market.

Bibliography

Alt, R., Beck, R., & Smits, M. T. (2018). FinTech and the transformation of the financial industry. Electronic Markets, 28(3), 235–243. https://doi.org/10.1007/s12525-018-0310-9

Anichebe, U. (2019). How regulations can define the future of fintech in Nigeria. Available at SSRN : Https://Ssrn.Com/Abstract=3354278. https://ssrn.com/abstract=3354278

Hornuf, L., Klus, M. F., Lohwasser, T. S., & Schwienbacher, A. (2020). How do banks interact with fintech startups? Small Business Economics. https://doi.org/10.1007/s11187-020-00359-3

Joshi, A., Kale, S., Chandel, S., & Pal, D. (2015). Likert Scale: Explored and Explained. British Journal of Applied Science & Technology, 7(4), 396–403. https://doi.org/10.9734/bjast/2015/14975

Kola-Oyeneyin, E., Kuyoro, M., & Olanrewaju, T. (2020). Harnessing Nigeria ’ s fintech potential. McKinsey & Company, September.

Kyari, A. K. (2020). Managing fintech’s destruction through innovative banking: An empirical investigation. International Journal of Innovation, Creativity and Change, 13(1), 253–274.

Mathew, A. (2018). Fluid Expectations in Placemaking: Four Trends and Strategies. Vamonde. https://medium.com/vamonde/fluid-expectations-in-placemaking-four-trends-and-strategies-1f2a5b31f247

Matt, C., Hess, T., & Benlian, A. (2015). Digital Transformation Strategies. Business & Information Systems Engineering, 57(5), 339–343. https://doi.org/10.1007/s12599-015-0401-5

Ojo, O. V., & Nwaokike, U. (2018). Disruptive Technology and The Fintech Industry In Nigeria: Imperatives for Legal and Policy Responses. 9(3).

Steeves, B. D. (2016). The Social Impact of FinTech in Nigeria Contributions to State Monetary Policies Support for Small Business and Entrepreneurs. 78–80.

Vial, G. (2019). Understanding digital transformation: A review and a research agenda. Journal of Strategic Information Systems, 28(2), 118–144. https://doi.org/10.1016/j.jsis.2019.01.003

Westerman, G., Bonnet, D., & Mcafee, A. (2014). The Nine Elements of Digital Transformation Opinion & Analysis. MIT Sloan Management Review.

Article by Benjamin Alao, approved by lecturer George Alexander.